An eventful March sees the SME economy simmering

The Fed introduced another rate hike on March 22, as a new round of banking crises dominated the headlines.

In the face of these broader economic headwinds, our data for the United States and Canada show a month-over-month decline in employment activity among SMEs.

A further Federal Reserve rate hike in March has many worried about the economy's continued warmth and the effectiveness of national leaders' approach to tackling the crisis. inflation. As in previous versions of this report, Homebase seeks to understand how the broader economic environment is affecting small businesses and their employees at the start of 2023 by analyzing behavioral data from more than two million employees working in more than one hundred thousand SME.

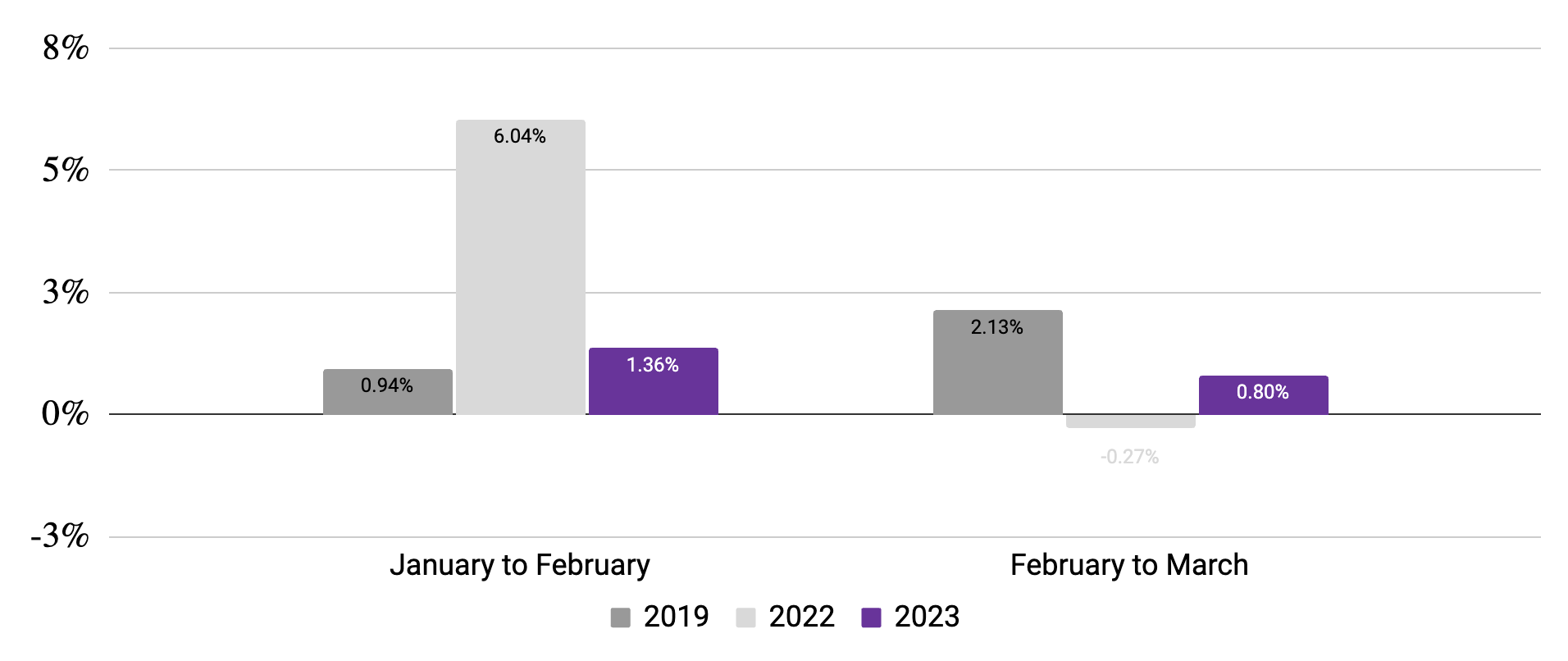

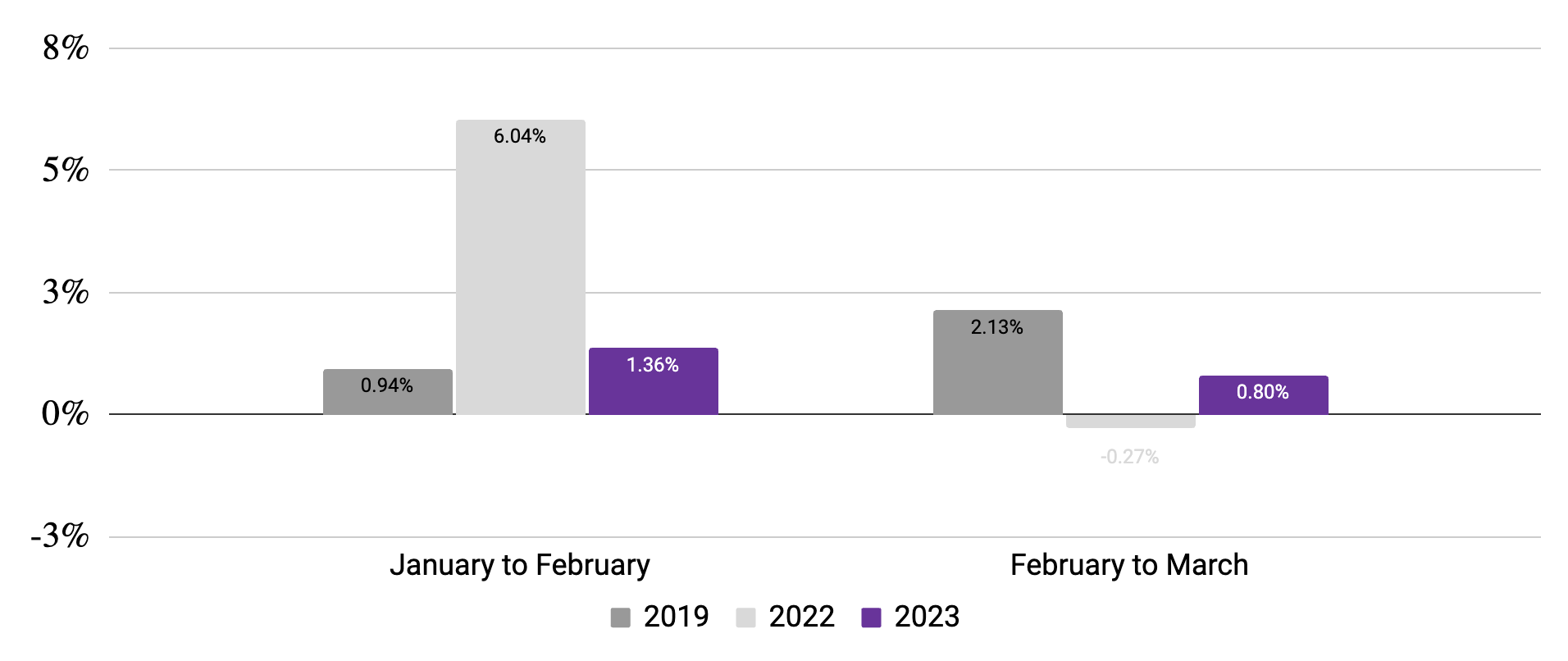

Summary of Findings: Key activity markers are stable or declining from mid-February levels, and the downward trend has accelerated through the end of March. A once-hot economy is showing signs of slowing; the basic indicators showed none of the seasonal growth that we have seen in previous years. Hospitality and entertainment diverged from other industries with increased activity in March - driven by the spring break, activity in the leisure industries topped a declining trend across the board. The average metro area saw little to no economic growth from February to March. Wage inflation picked up by 0.58% in March, in line with the moderate growth observed at the end of 2022.

Main Street economic activity shows signs of slowing

After a strong start to the year, active employees and public businesses both posted a downward trajectory over the past month. This goes against the usual seasonal patterns.

Employees working (Monthly change in 7-day average, relative to January of current year)

Hospitality and entertainment continue to be growth highlights as activity in other sectors declines

Hospitality and entertainment both saw significant increases in the number of employees working over the past month (4.5% and 5.5%, respectively), although the increase in leisure during the March spring break was less than pre-COVID.

Beauty and wellness saw the largest decline from February to March, down around 3%, while other sectors were relatively flat.

Percentage change in the number of employees working (mid-February vs. mid-January, using January 2019 and January 23 baseline)1

The average metropolitan area has seen weak growth in employment activity

...

...

The Fed introduced another rate hike on March 22, as a new round of banking crises dominated the headlines.

In the face of these broader economic headwinds, our data for the United States and Canada show a month-over-month decline in employment activity among SMEs.

A further Federal Reserve rate hike in March has many worried about the economy's continued warmth and the effectiveness of national leaders' approach to tackling the crisis. inflation. As in previous versions of this report, Homebase seeks to understand how the broader economic environment is affecting small businesses and their employees at the start of 2023 by analyzing behavioral data from more than two million employees working in more than one hundred thousand SME.

Summary of Findings: Key activity markers are stable or declining from mid-February levels, and the downward trend has accelerated through the end of March. A once-hot economy is showing signs of slowing; the basic indicators showed none of the seasonal growth that we have seen in previous years. Hospitality and entertainment diverged from other industries with increased activity in March - driven by the spring break, activity in the leisure industries topped a declining trend across the board. The average metro area saw little to no economic growth from February to March. Wage inflation picked up by 0.58% in March, in line with the moderate growth observed at the end of 2022.

Main Street economic activity shows signs of slowing

After a strong start to the year, active employees and public businesses both posted a downward trajectory over the past month. This goes against the usual seasonal patterns.

Employees working (Monthly change in 7-day average, relative to January of current year)

Hospitality and entertainment continue to be growth highlights as activity in other sectors declines

Hospitality and entertainment both saw significant increases in the number of employees working over the past month (4.5% and 5.5%, respectively), although the increase in leisure during the March spring break was less than pre-COVID.

Beauty and wellness saw the largest decline from February to March, down around 3%, while other sectors were relatively flat.

Percentage change in the number of employees working (mid-February vs. mid-January, using January 2019 and January 23 baseline)1

The average metropolitan area has seen weak growth in employment activity

...

...

What's Your Reaction?