'Back to work' pension reform risks costing the Treasury £100,000 per job, think tank warns

Sign up for View email from Westminster for expert analytics straight to your inboxReceive our free email View from WestminsterPlease enter a valid email addressPlease enter a valid email addressI would like to receive emails about offers, events and updates day of The Independent. Read our privacy notice{{ #verifyErrors }}{{ message }}{{ /verifyErrors }}{{ ^verifyErrors }}An error has occurred. Please try again later{{ /verifyErrors }}

Sign up for View email from Westminster for expert analytics straight to your inboxReceive our free email View from WestminsterPlease enter a valid email addressPlease enter a valid email addressI would like to receive emails about offers, events and updates day of The Independent. Read our privacy notice{{ #verifyErrors }}{{ message }}{{ /verifyErrors }}{{ ^verifyErrors }}An error has occurred. Please try again later{{ /verifyErrors }}

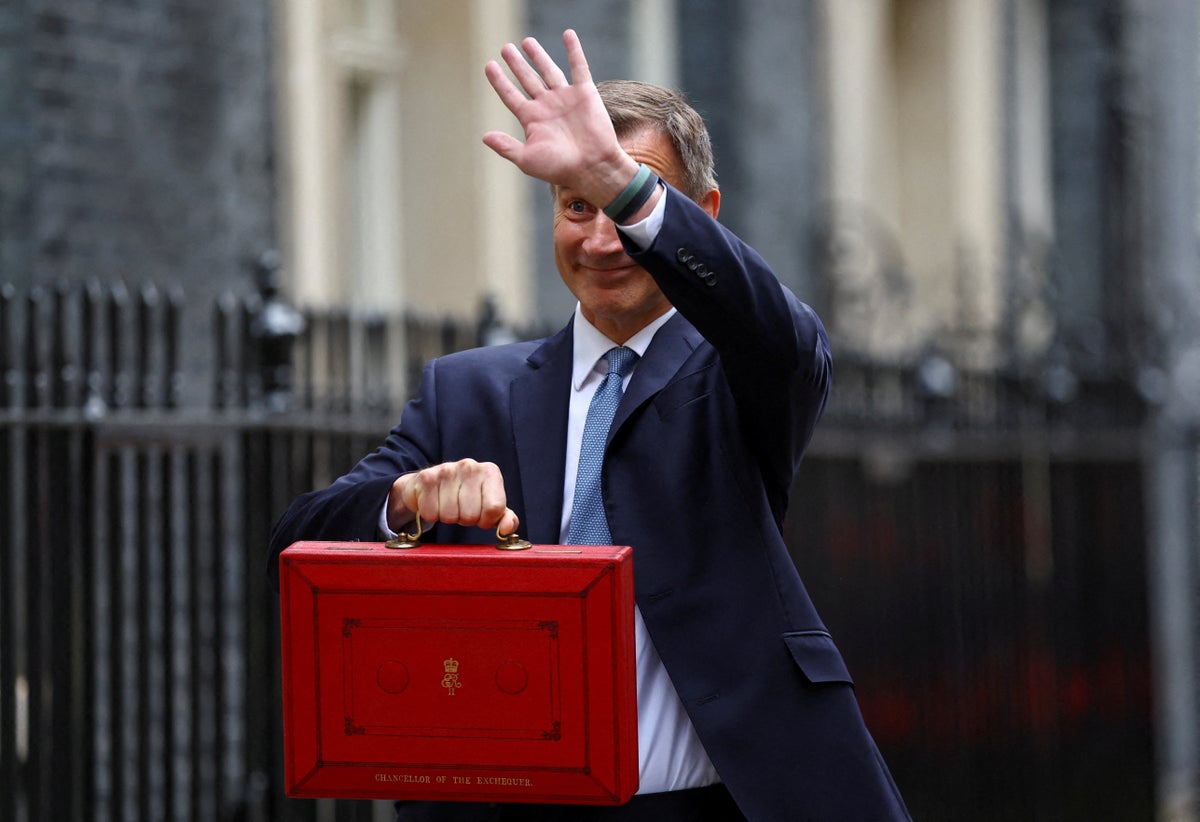

Jeremy Hunt's multi-billion pound pension gift in the budget may not increase the number of people in work and could open an inheritance tax loophole for the wealthy , experts have warned.

The highly respected Institute for Fiscal Studies (IFS) think tank said the policy risked costing £100,000 per job as it warned households would feel "a continuing pain over" the next year as wages fail to catch up with prices during a "lost decade" of living standards.

Mr. Hunt used his back-to-work budget to scrap the tax-free cap on retirement savings and announce plans to expand free toddler care.

The measures were designed to prevent doctors from leaving the NHS early because they have reached the limit and to convince more mothers to return to the workforce.

But Paul Johnson, the director of the IFS, said scrapping the pension cap was a billion-pound sledgehammer 'to crack a nut'. Politics "won't play a big role, if at all, in getting more people to work," he said, adding it was hard to predict whether the move would convince doctors to stay in. the NHS or allow more of them to retire earlier.

The Independent Office for Budget Accountability (OBR) estimates that the pension reform will only increase the overall workforce by 15,000 people. The Treasury said it could not say how many of them will be doctors.

It is also estimated that childcare reforms will cost £70,000 per person re-entering the workforce.

The IFS also warned that the reforms could increase the cost of hours not covered by the subsidy. The current system, which applies to three- and four-year-olds, offers only 30 free hours for 38 out of 52 weeks. Experts also point out that many full-time working parents place their child in child care for well over 30 hours per week.

The IFS also warned that pension pots are exempt from inheritance tax, adding "thus these are additional grants that are going to be distributed to people who make very large savings under these reforms".

The Resolution Foundation also called the reforms "unnecessary tax relief for wealthy savers" that could see some workers choose to retire early or use their now uncapped retirement savings to avoid inheritance tax.

Torsten Bell, Chief Executive of the think tank said: "This is a big win for NHS consultants, but bad value for money for Great Britain. Brittany."

Mr. Johnson also said that projections suggest disposable incomes will be only marginally higher in 2027 than in 2017 in what he described as a "lost decade for living standards."

“ What is household g...

Sign up for View email from Westminster for expert analytics straight to your inboxReceive our free email View from WestminsterPlease enter a valid email addressPlease enter a valid email addressI would like to receive emails about offers, events and updates day of The Independent. Read our privacy notice{{ #verifyErrors }}{{ message }}{{ /verifyErrors }}{{ ^verifyErrors }}An error has occurred. Please try again later{{ /verifyErrors }}

Sign up for View email from Westminster for expert analytics straight to your inboxReceive our free email View from WestminsterPlease enter a valid email addressPlease enter a valid email addressI would like to receive emails about offers, events and updates day of The Independent. Read our privacy notice{{ #verifyErrors }}{{ message }}{{ /verifyErrors }}{{ ^verifyErrors }}An error has occurred. Please try again later{{ /verifyErrors }}Jeremy Hunt's multi-billion pound pension gift in the budget may not increase the number of people in work and could open an inheritance tax loophole for the wealthy , experts have warned.

The highly respected Institute for Fiscal Studies (IFS) think tank said the policy risked costing £100,000 per job as it warned households would feel "a continuing pain over" the next year as wages fail to catch up with prices during a "lost decade" of living standards.

Mr. Hunt used his back-to-work budget to scrap the tax-free cap on retirement savings and announce plans to expand free toddler care.

The measures were designed to prevent doctors from leaving the NHS early because they have reached the limit and to convince more mothers to return to the workforce.

But Paul Johnson, the director of the IFS, said scrapping the pension cap was a billion-pound sledgehammer 'to crack a nut'. Politics "won't play a big role, if at all, in getting more people to work," he said, adding it was hard to predict whether the move would convince doctors to stay in. the NHS or allow more of them to retire earlier.

The Independent Office for Budget Accountability (OBR) estimates that the pension reform will only increase the overall workforce by 15,000 people. The Treasury said it could not say how many of them will be doctors.

It is also estimated that childcare reforms will cost £70,000 per person re-entering the workforce.

The IFS also warned that the reforms could increase the cost of hours not covered by the subsidy. The current system, which applies to three- and four-year-olds, offers only 30 free hours for 38 out of 52 weeks. Experts also point out that many full-time working parents place their child in child care for well over 30 hours per week.

The IFS also warned that pension pots are exempt from inheritance tax, adding "thus these are additional grants that are going to be distributed to people who make very large savings under these reforms".

The Resolution Foundation also called the reforms "unnecessary tax relief for wealthy savers" that could see some workers choose to retire early or use their now uncapped retirement savings to avoid inheritance tax.

Torsten Bell, Chief Executive of the think tank said: "This is a big win for NHS consultants, but bad value for money for Great Britain. Brittany."

Mr. Johnson also said that projections suggest disposable incomes will be only marginally higher in 2027 than in 2017 in what he described as a "lost decade for living standards."

“ What is household g...

What's Your Reaction?

![Three of ID's top PR executives quit ad firm Powerhouse [EXCLUSIVE]](https://variety.com/wp-content/uploads/2023/02/ID-PR-Logo.jpg?#)