Celsius vows to return from bankruptcy but expert fears Mt. Gox repeat

The company says it plans to continue operations through the restructuring process, although withdrawals will continue to be suspended for the moment.

New

New

Crypto lending platform Celsius confirmed on Wednesday that it has filed Chapter 11 bankruptcy proceedings in court for the Southern District of New York.

The announcement was shared on the company's Twitter and shared with account holders via email on Wednesday, with a wish to "come out of Chapter 11 positioned for success in the cryptocurrency industry" .

According to Investopedia, a Chapter 11 bankruptcy allows a company to stay in business and restructure its obligations. Companies that have successfully reorganized under Chapter 11 include American Airlines, Delta, General Motors, Hertz and Marvel, according to an updated FAQ from Celsius.

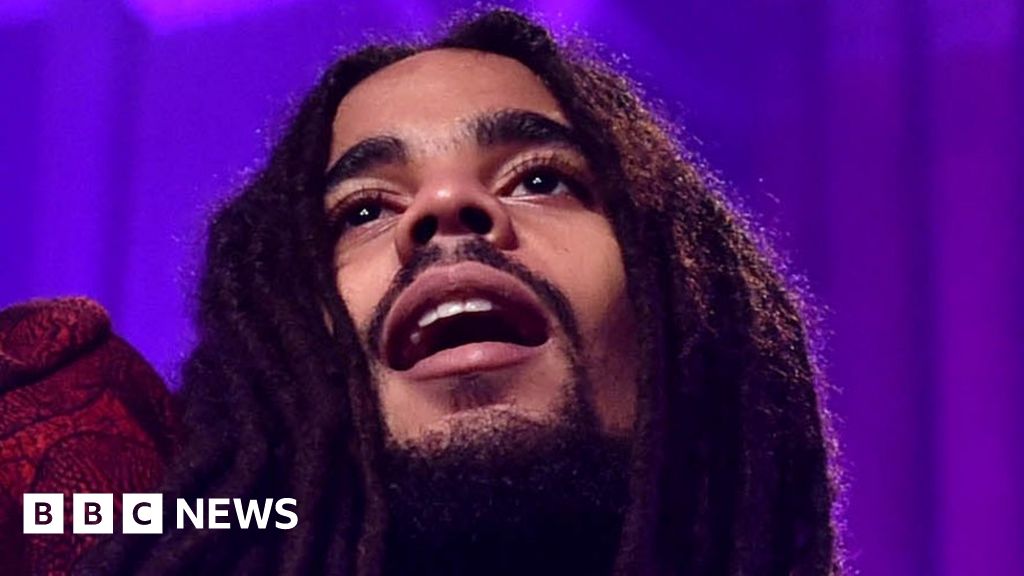

Danny Talwar, head of tax at crypto-accounting software firm Koinly, has raised concerns with Cointelegraph that the procedure could mean Celsius investors and clients may not see their funds returned within 10 days. a "foreseeable future", similar to the fallout from the Mt. Gox hack in 2014 which is still ongoing:

“It could be Mt. Gox 2.0. Legal proceedings may prolong the process of recovering one of their deposits from Celsius customers in the future.”

“For context, Mt. Gox was the largest Bitcoin exchange from 2010 until its collapse in 2014, losing over 850,000 BTC in deposits,” Talwar explained. "Clients are still awaiting the release of funds from the exchange now (in 2022), with legal proceedings in multiple jurisdictions around the world and in Japan."

Celsius, in a statement on Wednesday, said it intended to use $167 million in cash to continue "certain operations" during the restructuring process and said it intended to "restore activity across the platform" and "return value to customers."

However, client withdrawals should remain paused "for the time being".

Celsius board members say the move into bankruptcy follows a “difficult but necessary” decision last month to suspend withdrawals, trading and transfers on the platform.

>...

The company says it plans to continue operations through the restructuring process, although withdrawals will continue to be suspended for the moment.

New

New

Crypto lending platform Celsius confirmed on Wednesday that it has filed Chapter 11 bankruptcy proceedings in court for the Southern District of New York.

The announcement was shared on the company's Twitter and shared with account holders via email on Wednesday, with a wish to "come out of Chapter 11 positioned for success in the cryptocurrency industry" .

According to Investopedia, a Chapter 11 bankruptcy allows a company to stay in business and restructure its obligations. Companies that have successfully reorganized under Chapter 11 include American Airlines, Delta, General Motors, Hertz and Marvel, according to an updated FAQ from Celsius.

Danny Talwar, head of tax at crypto-accounting software firm Koinly, has raised concerns with Cointelegraph that the procedure could mean Celsius investors and clients may not see their funds returned within 10 days. a "foreseeable future", similar to the fallout from the Mt. Gox hack in 2014 which is still ongoing:

“It could be Mt. Gox 2.0. Legal proceedings may prolong the process of recovering one of their deposits from Celsius customers in the future.”

“For context, Mt. Gox was the largest Bitcoin exchange from 2010 until its collapse in 2014, losing over 850,000 BTC in deposits,” Talwar explained. "Clients are still awaiting the release of funds from the exchange now (in 2022), with legal proceedings in multiple jurisdictions around the world and in Japan."

Celsius, in a statement on Wednesday, said it intended to use $167 million in cash to continue "certain operations" during the restructuring process and said it intended to "restore activity across the platform" and "return value to customers."

However, client withdrawals should remain paused "for the time being".

Celsius board members say the move into bankruptcy follows a “difficult but necessary” decision last month to suspend withdrawals, trading and transfers on the platform.

>...

What's Your Reaction?

![Three of ID's top PR executives quit ad firm Powerhouse [EXCLUSIVE]](https://variety.com/wp-content/uploads/2023/02/ID-PR-Logo.jpg?#)