Create a retirement plan when you are self-employed

Freelancing has many benefits: you can create your own schedule, retain creative control over your work, and pursue your passion more effectively. However, one downside is not having an employer pension plan to secure your financial future.

Due - Due

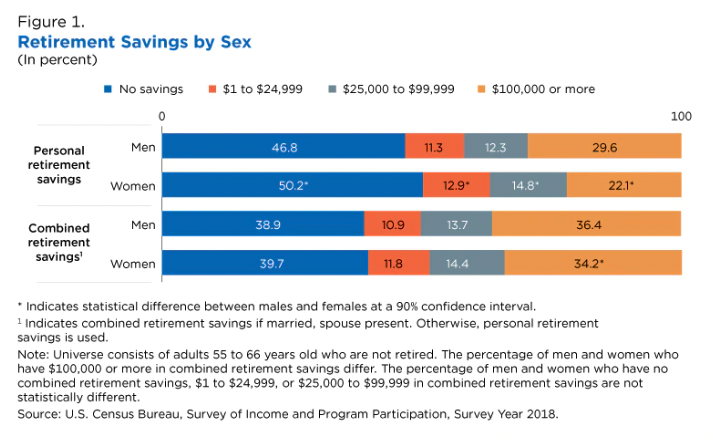

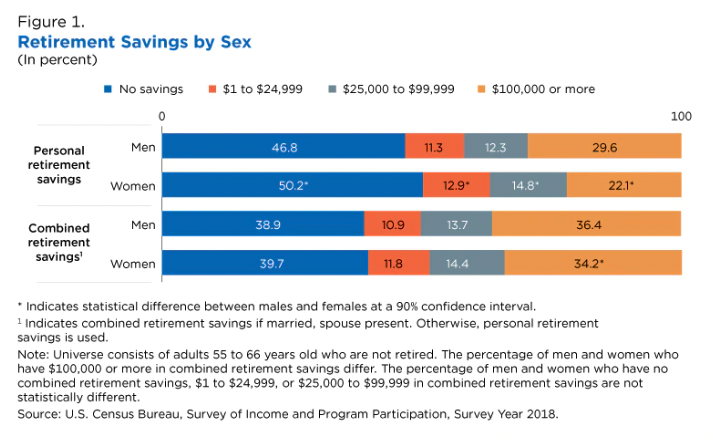

Due - DueAccording to the U.S. Census Bureau, 49% of Americans between the ages of 55 and 65 are not financially prepared for retirement. Women, in particular, make up most of those with no retirement savings at 50%.

Self-employment means you have to save enough money yourself for your future retirement. Fortunately, there are options to help you secure enough savings even without a traditional 9 to 5 career.

Why should you save for retirementWe can become accustomed to a particular way of life throughout our working lives. In addition to having a roof over our heads, our income allows us to enjoy the simple pleasures of life like eating out, having fun, traveling, giving gifts, shopping and more. When we retire, many of us only have the savings in our bank accounts and our Social Security benefits. For many people who choose not to contribute to a retirement plan, living through their golden years requires considerable sacrifice and the potential for financial hardship.

You may find excuses not to invest in your future after retirement, but there are many reasons why you should reconsider, such as the following:

Social Security benefits are often not enough to maintain your current lifestyle. You don't want to burden your children with your financial difficulties. A retirement plan gives you access to a tax-deferred retirement account that reduces your taxes. Investing in your retirement account allows you to enjoy your non-working years more comfortably and with less worry.For self-employed people who think their Social Security benefits will help them get by after retirement, the Social Security Administration (SSA) doesn't hold up.

The SSA states that Social Security benefits are only 40% of your highest earnings over 35 years at retirement age. Plus, financial advisors agree that you probably need about 70% of pre-retirement income (including Social Security, personal savings, investments, and other retirement accounts) to live comfortably without income. .

4 retirement plan options for the self-employedSaving for retirement is essential, especially if you are self-employed. Sole proprietors have many options, but these four savings plans are the most common.

Single Participant 401(k)Company employees may have the option of participating in a 401(k) retirement plan. Self-employed people can still contribute to a 401(k) - however, it will only be for one participant.

A single-member 401(k) works the same way as a workplace retirement plan, meaning you make pre-tax contributions that are taxed when you start making withdrawals from 59 1/2. Some people may refer to these 401(k) plans as individual 401(k), solo 401(k), uni-401(k), or self-employed 401(k).

Contributing to a solo 401(k) is possible, regardless of age or income. Starting in 2022, individuals can contribute up to $61,000, while anyone over age 50 can add a $6,500 catch-up contribution.

Freelancing has many benefits: you can create your own schedule, retain creative control over your work, and pursue your passion more effectively. However, one downside is not having an employer pension plan to secure your financial future.

Due - Due

Due - DueAccording to the U.S. Census Bureau, 49% of Americans between the ages of 55 and 65 are not financially prepared for retirement. Women, in particular, make up most of those with no retirement savings at 50%.

Self-employment means you have to save enough money yourself for your future retirement. Fortunately, there are options to help you secure enough savings even without a traditional 9 to 5 career.

Why should you save for retirementWe can become accustomed to a particular way of life throughout our working lives. In addition to having a roof over our heads, our income allows us to enjoy the simple pleasures of life like eating out, having fun, traveling, giving gifts, shopping and more. When we retire, many of us only have the savings in our bank accounts and our Social Security benefits. For many people who choose not to contribute to a retirement plan, living through their golden years requires considerable sacrifice and the potential for financial hardship.

You may find excuses not to invest in your future after retirement, but there are many reasons why you should reconsider, such as the following:

Social Security benefits are often not enough to maintain your current lifestyle. You don't want to burden your children with your financial difficulties. A retirement plan gives you access to a tax-deferred retirement account that reduces your taxes. Investing in your retirement account allows you to enjoy your non-working years more comfortably and with less worry.For self-employed people who think their Social Security benefits will help them get by after retirement, the Social Security Administration (SSA) doesn't hold up.

The SSA states that Social Security benefits are only 40% of your highest earnings over 35 years at retirement age. Plus, financial advisors agree that you probably need about 70% of pre-retirement income (including Social Security, personal savings, investments, and other retirement accounts) to live comfortably without income. .

4 retirement plan options for the self-employedSaving for retirement is essential, especially if you are self-employed. Sole proprietors have many options, but these four savings plans are the most common.

Single Participant 401(k)Company employees may have the option of participating in a 401(k) retirement plan. Self-employed people can still contribute to a 401(k) - however, it will only be for one participant.

A single-member 401(k) works the same way as a workplace retirement plan, meaning you make pre-tax contributions that are taxed when you start making withdrawals from 59 1/2. Some people may refer to these 401(k) plans as individual 401(k), solo 401(k), uni-401(k), or self-employed 401(k).

Contributing to a solo 401(k) is possible, regardless of age or income. Starting in 2022, individuals can contribute up to $61,000, while anyone over age 50 can add a $6,500 catch-up contribution.

What's Your Reaction?

![Three of ID's top PR executives quit ad firm Powerhouse [EXCLUSIVE]](https://variety.com/wp-content/uploads/2023/02/ID-PR-Logo.jpg?#)