Dubai-based Stake raises $8m to empower people around the world to invest in local properties

Dubai-based startup Stake offers retail investors around the world the opportunity to buy fractional rental properties in the UAE's flagship city and earn a steady income. The startup, founded in 2020, claims that due to Dubai's real estate rules, it has managed to attract investor users to the platform from more than 80 countries around the world.

The company, founded by Manar Mahmassani, Rami Tabbara and Ricardo Brizido in 2020, raised $8 million in a pre-Series A round from investors including BY Ventures, MEVP and Vivium Holdings to expand its portfolio and launch in Saudi Arabia. Arabia and Egypt. The company raised $4 million for the first time last year.

“This round is a testament to what we are building at Stake and our mission to provide access and liquidity to the oldest, largest and most sought-after asset class in the world. to grow in Saudi Arabia and Egypt, continue to attract top talent to the team, and solidify Stake's position as the category leader in the MENA region,” Mahmassani said in a written statement. /p>

Tabbara told TechCrunch on a call that after being in the real estate industry for more than 15 years, he realized that a lot of people want to invest in the MENA region but they cannot afford to invest large sums of money without paying huge commissions to brokers and developers. So he wanted to speed up the process of investing in real estate with Stake.

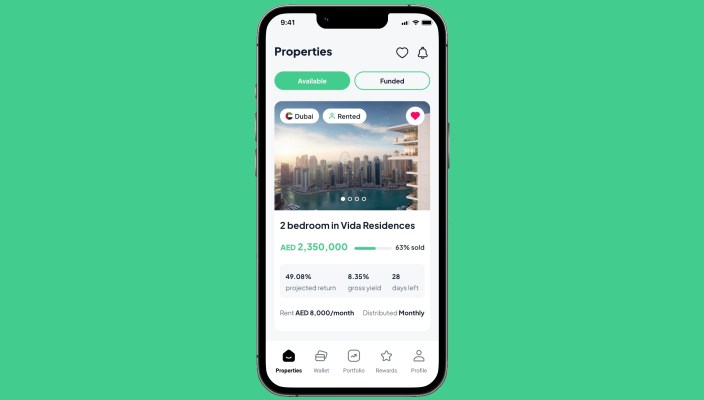

Image credits: Stake< /p>

The company says it lists high-end properties on its platform that are already for rent. To acquire a property, Stake looks at factors such as location, build quality, views and whether there are tenants. Tabbara said if the property is not rented, the company uses its data to list properties that could be rented out quickly. Stake has paid out over AED 1 million ($272,249) in rental income to investors, which is credited monthly.

Stake currently manages over 44 properties with a combined value of AED56 million ($17.9 million). The company claims to have achieved an average monthly growth rate of 17% for both investors and assets under management (AUM).

"Our platform currently has 42,000 registered users and over 2,100 active investors on the platform. Although we have users from many countries on the site, people from the United Arab Emirates, Saudi Saudi Arabia, Kuwait, UK and India are our top five investor bases,” Tabbara said.

Users can quickly register on the platform and invest from AED 500 ($136). Due to Dubai investment rules, individual investors can only invest up to AED 183,500 ($50,000) per year. The proptech company also limits a single investor's maximum ownership in a property to 33% to spread the gains evenly.

The company does not rely on financing to acquire homes. All the money to buy a property comes from investors. While Dubai's property rule allows for partial deeds, there is a cap of four investors, so Stake creates a special purpose vehicle for each property to make registering deeds easier. All properties typically have an investment term of five periods, but a house goes up in value by 30% in the market and investors can vote to sell it.

Stake's business model is based on various fees. When investors buy a property, the company charges them 1.5% with an additional 0.5% charged annually for maintenance. Additionally, there are 0.2% Know Your Customer (KYC) and Anti-Money Laundering fees up front and 0.1% per year from the second year of the term. The company also charges investors a 2.5% exit fee with...

Dubai-based startup Stake offers retail investors around the world the opportunity to buy fractional rental properties in the UAE's flagship city and earn a steady income. The startup, founded in 2020, claims that due to Dubai's real estate rules, it has managed to attract investor users to the platform from more than 80 countries around the world.

The company, founded by Manar Mahmassani, Rami Tabbara and Ricardo Brizido in 2020, raised $8 million in a pre-Series A round from investors including BY Ventures, MEVP and Vivium Holdings to expand its portfolio and launch in Saudi Arabia. Arabia and Egypt. The company raised $4 million for the first time last year.

“This round is a testament to what we are building at Stake and our mission to provide access and liquidity to the oldest, largest and most sought-after asset class in the world. to grow in Saudi Arabia and Egypt, continue to attract top talent to the team, and solidify Stake's position as the category leader in the MENA region,” Mahmassani said in a written statement. /p>

Tabbara told TechCrunch on a call that after being in the real estate industry for more than 15 years, he realized that a lot of people want to invest in the MENA region but they cannot afford to invest large sums of money without paying huge commissions to brokers and developers. So he wanted to speed up the process of investing in real estate with Stake.

Image credits: Stake< /p>

The company says it lists high-end properties on its platform that are already for rent. To acquire a property, Stake looks at factors such as location, build quality, views and whether there are tenants. Tabbara said if the property is not rented, the company uses its data to list properties that could be rented out quickly. Stake has paid out over AED 1 million ($272,249) in rental income to investors, which is credited monthly.

Stake currently manages over 44 properties with a combined value of AED56 million ($17.9 million). The company claims to have achieved an average monthly growth rate of 17% for both investors and assets under management (AUM).

"Our platform currently has 42,000 registered users and over 2,100 active investors on the platform. Although we have users from many countries on the site, people from the United Arab Emirates, Saudi Saudi Arabia, Kuwait, UK and India are our top five investor bases,” Tabbara said.

Users can quickly register on the platform and invest from AED 500 ($136). Due to Dubai investment rules, individual investors can only invest up to AED 183,500 ($50,000) per year. The proptech company also limits a single investor's maximum ownership in a property to 33% to spread the gains evenly.

The company does not rely on financing to acquire homes. All the money to buy a property comes from investors. While Dubai's property rule allows for partial deeds, there is a cap of four investors, so Stake creates a special purpose vehicle for each property to make registering deeds easier. All properties typically have an investment term of five periods, but a house goes up in value by 30% in the market and investors can vote to sell it.

Stake's business model is based on various fees. When investors buy a property, the company charges them 1.5% with an additional 0.5% charged annually for maintenance. Additionally, there are 0.2% Know Your Customer (KYC) and Anti-Money Laundering fees up front and 0.1% per year from the second year of the term. The company also charges investors a 2.5% exit fee with...

What's Your Reaction?

![Three of ID's top PR executives quit ad firm Powerhouse [EXCLUSIVE]](https://variety.com/wp-content/uploads/2023/02/ID-PR-Logo.jpg?#)