Investor Alert: We have NOT hit rock bottom!

The bears have been in charge for 2 months and will probably rest for a while. So while we've seen some powerful rebounds this week...and we may see more in the coming days...make no mistake. We still have a long way to go before we find the bottom. Why is this the case? How high will the S&P 500 (SPY) go? How to take advantage of it in the weeks to come? Read below for the answers.

shutterstock.com - StockNews

shutterstock.com - StockNewsIt was a very interesting week for stocks. Many times pre-market activity pointed in one direction...then the script was reversed.

Overall, we still have a week to hit new lows as inflation does not subside, which means a more vigilant Fed, which means a higher likelihood of a recession down the road, which means more downside for stocks.

Let's recap the week that followed with what investors are likely to expect in the coming weeks. This goes hand in hand with updates to our trading plan to stay on the bright side of the action.

Market Commentary

Equities retested lows on Tuesday. This made the bulls eager to take advantage of a healthy rebound ahead of Wednesday's trade as it looked like a good buying opportunity.

NOT SO FAST!

Next is the Producer Price Index (PPI) report which shows that inflation is too high. In fact, it was the month-over-month increase that doubled expectations that alarmed investors as it was the first monthly increase in three months.

The report showed that inflation is happening EVERYWHERE. It's not just about high energy prices anymore. Inflation has gotten sticky in just about every category imaginable.

Remember that the PPI is the most widely followed leading indicator of the CPI's future position. This means that inflation is "not going quietly into this good night" any time soon. And why that healthy pre-market bounce immediately evaporated with another test of the S&P 500 (SPY) lows in store Wednesday.

A near repeat of Wednesday's action took place on Thursday. Stocks were poised for a big rebound in the pre-market only for another inflation report too hot (CPI) to rain on everyone's parade. This triggered another big sell-off to new lows, one tick below 3500.

From there, a big rally ensued to close the day at 3,669.91. Nothing about this bounce felt like it was built from solid logic and rationality. It all felt like computers looking at 3,500 as a foothold and a place to have fun for a few hours.

Furthermore, the groups that outperformed were among the most defensive groups. The ones you hold on to during a bear market and lose at the start of the next bull market.

It's no surprise that investors were doused in cold water on Friday when they tried to rally once again to find a very weak retail sales report. Yes, it has increased...but less than the rate of inflation, which means consumer spending is slowing.

All of the above indicates that...THIS IS NOT DOWN

Recall that the average bear market is down 34%. That would equate to 3,180 this time around.

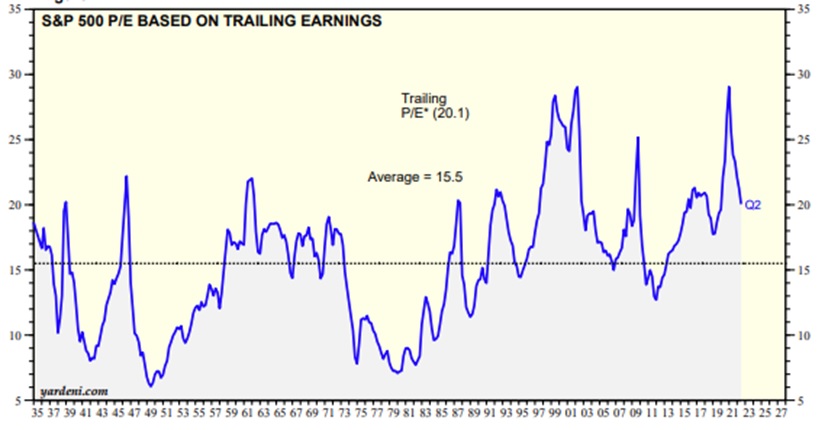

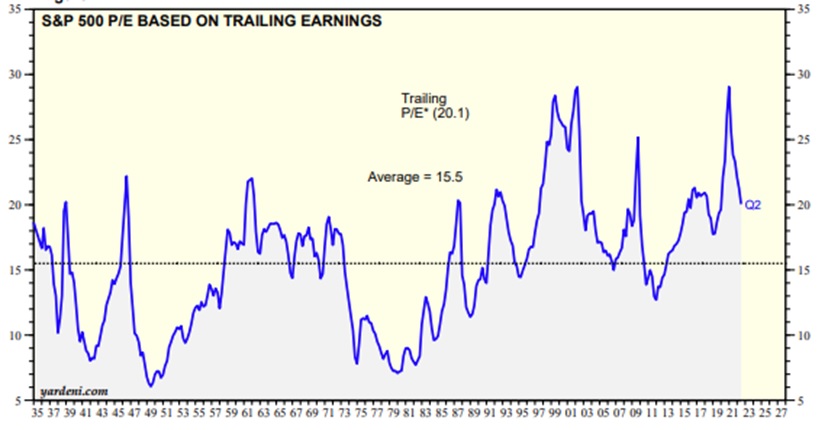

Now let's remember that overall market valuations prior to the start of this bear market were at an all-time high. Yes, the overall S&P 500 (SPY) PE was actually a notch higher at the start of 2022 than it was at the top of the tech bubble in 1999.

Now, let's remember that one of the things to help find the bottom is a dovish Fed that is aggressively CUTTING rates to help revive the economy and kick-start investment. Yet right now the exact opposite is happening as the Fed has an aggressive rate hike regimen to snuff out the raging flames of inflation. (Read more about this in my recent article: Hidden Reason for Bloodier Bear Market).

Long story short, NOTHING on Thursday's rally says the real, lasting bottom has been found. But yes, bear markets do have meteoric bounces along the way.

Some short...some long...but not all are built to last.

When investors can finally appreciate the true virulence of the coming recession and estimate the full damage to the earnings outlook, then and only then can we start tackling...

The bears have been in charge for 2 months and will probably rest for a while. So while we've seen some powerful rebounds this week...and we may see more in the coming days...make no mistake. We still have a long way to go before we find the bottom. Why is this the case? How high will the S&P 500 (SPY) go? How to take advantage of it in the weeks to come? Read below for the answers.

shutterstock.com - StockNews

shutterstock.com - StockNewsIt was a very interesting week for stocks. Many times pre-market activity pointed in one direction...then the script was reversed.

Overall, we still have a week to hit new lows as inflation does not subside, which means a more vigilant Fed, which means a higher likelihood of a recession down the road, which means more downside for stocks.

Let's recap the week that followed with what investors are likely to expect in the coming weeks. This goes hand in hand with updates to our trading plan to stay on the bright side of the action.

Market Commentary

Equities retested lows on Tuesday. This made the bulls eager to take advantage of a healthy rebound ahead of Wednesday's trade as it looked like a good buying opportunity.

NOT SO FAST!

Next is the Producer Price Index (PPI) report which shows that inflation is too high. In fact, it was the month-over-month increase that doubled expectations that alarmed investors as it was the first monthly increase in three months.

The report showed that inflation is happening EVERYWHERE. It's not just about high energy prices anymore. Inflation has gotten sticky in just about every category imaginable.

Remember that the PPI is the most widely followed leading indicator of the CPI's future position. This means that inflation is "not going quietly into this good night" any time soon. And why that healthy pre-market bounce immediately evaporated with another test of the S&P 500 (SPY) lows in store Wednesday.

A near repeat of Wednesday's action took place on Thursday. Stocks were poised for a big rebound in the pre-market only for another inflation report too hot (CPI) to rain on everyone's parade. This triggered another big sell-off to new lows, one tick below 3500.

From there, a big rally ensued to close the day at 3,669.91. Nothing about this bounce felt like it was built from solid logic and rationality. It all felt like computers looking at 3,500 as a foothold and a place to have fun for a few hours.

Furthermore, the groups that outperformed were among the most defensive groups. The ones you hold on to during a bear market and lose at the start of the next bull market.

It's no surprise that investors were doused in cold water on Friday when they tried to rally once again to find a very weak retail sales report. Yes, it has increased...but less than the rate of inflation, which means consumer spending is slowing.

All of the above indicates that...THIS IS NOT DOWN

Recall that the average bear market is down 34%. That would equate to 3,180 this time around.

Now let's remember that overall market valuations prior to the start of this bear market were at an all-time high. Yes, the overall S&P 500 (SPY) PE was actually a notch higher at the start of 2022 than it was at the top of the tech bubble in 1999.

Now, let's remember that one of the things to help find the bottom is a dovish Fed that is aggressively CUTTING rates to help revive the economy and kick-start investment. Yet right now the exact opposite is happening as the Fed has an aggressive rate hike regimen to snuff out the raging flames of inflation. (Read more about this in my recent article: Hidden Reason for Bloodier Bear Market).

Long story short, NOTHING on Thursday's rally says the real, lasting bottom has been found. But yes, bear markets do have meteoric bounces along the way.

Some short...some long...but not all are built to last.

When investors can finally appreciate the true virulence of the coming recession and estimate the full damage to the earnings outlook, then and only then can we start tackling...

What's Your Reaction?

![Three of ID's top PR executives quit ad firm Powerhouse [EXCLUSIVE]](https://variety.com/wp-content/uploads/2023/02/ID-PR-Logo.jpg?#)