Navigate rough waters

Over the past seven months, the world of venture capital and entrepreneurship has gone from "the only thing that matters is massive growth" to "the end of the world". For perspective, all you have to do is watch a dozen high-flying IPOs from 2020 or 2021 to see that the peak happened just before Thanksgiving.

Private markets are lagging behind public markets. It's not new. This time around, the lag was about a quarter, as many VCs started talking about what was going on at the start of the second quarter.

There's no doubt that we're in the middle of, well, whatever you want to call it. "Correction" and "Choppy Waters" is probably a generous expression for what's going on.

Having been through this as an entrepreneur in 1987, entrepreneur and VC in 2001, VC in 2008 and VC today, I understand that it is part of the entrepreneurial and business cycle. I also know a lot of people are freaking out right now. If you've never experienced this (like I didn't in 1987), it can be terrifying. If you're experienced and suddenly find yourself caught off guard for any number of reasons, it can be just as terrifying.

I no longer believe in clichés or prognoses such as "make sure you have three years of money in the bank" or "make an RIF fast and deep no matter what situation you find yourself in". On the contrary, I think it is essential that each company fully understands its current reality and makes quick and appropriate adjustments to it. This could mean “doing a fast and deep RIF or “making sure you have three years of money in the bank”, but there are many other things to consider and do.

I've been involved in companies that have taken advantage of these times to gain huge market share from failing competitors. I've also been in businesses that in those times simply failed. I've been involved in companies that have made adjustments, resisted, and come out stronger on the other side. And, I invested in brand new businesses founded during those times that ended up creating entirely new categories and extremely successful businesses.

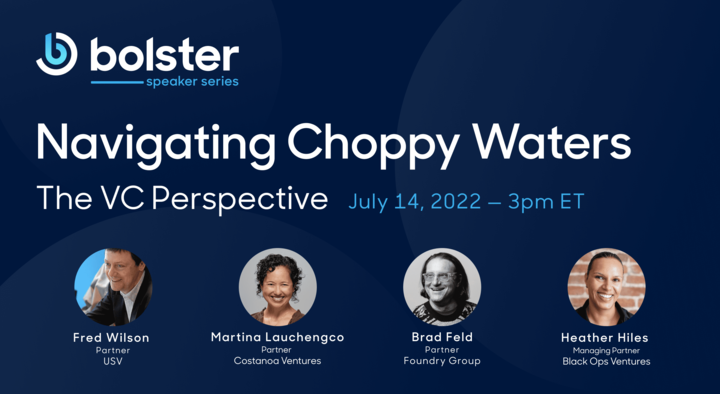

I guess that's the tone of what we'll be discussing on 7/14 in Bolster's lecture series on the VC perspective on rough water sailing. Fred Wilson has been through this many times, and his article on Amy and my 29th birthday in Staying Positive is a wonderful prospect. Martina Lauchengco and Heather Hiles are longtime operators turned VCs who have also been through many cycles.

Join us on 7/14 at 3pm ET for a discussion on rough water sailing that hopefully won't be full of the same old cliches that are circulating today.

Over the past seven months, the world of venture capital and entrepreneurship has gone from "the only thing that matters is massive growth" to "the end of the world". For perspective, all you have to do is watch a dozen high-flying IPOs from 2020 or 2021 to see that the peak happened just before Thanksgiving.

Private markets are lagging behind public markets. It's not new. This time around, the lag was about a quarter, as many VCs started talking about what was going on at the start of the second quarter.

There's no doubt that we're in the middle of, well, whatever you want to call it. "Correction" and "Choppy Waters" is probably a generous expression for what's going on.

Having been through this as an entrepreneur in 1987, entrepreneur and VC in 2001, VC in 2008 and VC today, I understand that it is part of the entrepreneurial and business cycle. I also know a lot of people are freaking out right now. If you've never experienced this (like I didn't in 1987), it can be terrifying. If you're experienced and suddenly find yourself caught off guard for any number of reasons, it can be just as terrifying.

I no longer believe in clichés or prognoses such as "make sure you have three years of money in the bank" or "make an RIF fast and deep no matter what situation you find yourself in". On the contrary, I think it is essential that each company fully understands its current reality and makes quick and appropriate adjustments to it. This could mean “doing a fast and deep RIF or “making sure you have three years of money in the bank”, but there are many other things to consider and do.

I've been involved in companies that have taken advantage of these times to gain huge market share from failing competitors. I've also been in businesses that in those times simply failed. I've been involved in companies that have made adjustments, resisted, and come out stronger on the other side. And, I invested in brand new businesses founded during those times that ended up creating entirely new categories and extremely successful businesses.

I guess that's the tone of what we'll be discussing on 7/14 in Bolster's lecture series on the VC perspective on rough water sailing. Fred Wilson has been through this many times, and his article on Amy and my 29th birthday in Staying Positive is a wonderful prospect. Martina Lauchengco and Heather Hiles are longtime operators turned VCs who have also been through many cycles.

Join us on 7/14 at 3pm ET for a discussion on rough water sailing that hopefully won't be full of the same old cliches that are circulating today.

What's Your Reaction?

![Three of ID's top PR executives quit ad firm Powerhouse [EXCLUSIVE]](https://variety.com/wp-content/uploads/2023/02/ID-PR-Logo.jpg?#)