Google Loses Two Leaders: One for Mail and Workspace, Another for Payments

Enlarge

Sean Gallup | Getty Images

Enlarge

Sean Gallup | Getty Images

Google fired two high-ranking executives this week. The first was Bill Ready, Google's "president of commerce, payments and the next billion users," who left to become CEO of Pinterest. The second big departure is Javier Soltero, who was vice president and general manager of Google Workspace, Google's paid business app, and who ran Google Messaging. Both executives brought big changes to Google during their nearly three-year stints at the company. Now that they're gone, it's unclear what the future of their respective products holds.

Ready only worked at Google for two and a half years, where his most high-profile decision was presiding over the disastrous rollout of a major redesign of Google Pay. The new Google Pay app was spearheaded by Ready's payments team, led by another recently ousted executive, Caesar Sengupta. The redesign of Google Pay brought an app originally developed for India to the United States, where the requirement for a phone number-based identity came with a long list of downgrades: Google Pay's website had to be stripped of payment functionality, the app no longer supported accounts, and you couldn't be signed in to multiple devices.

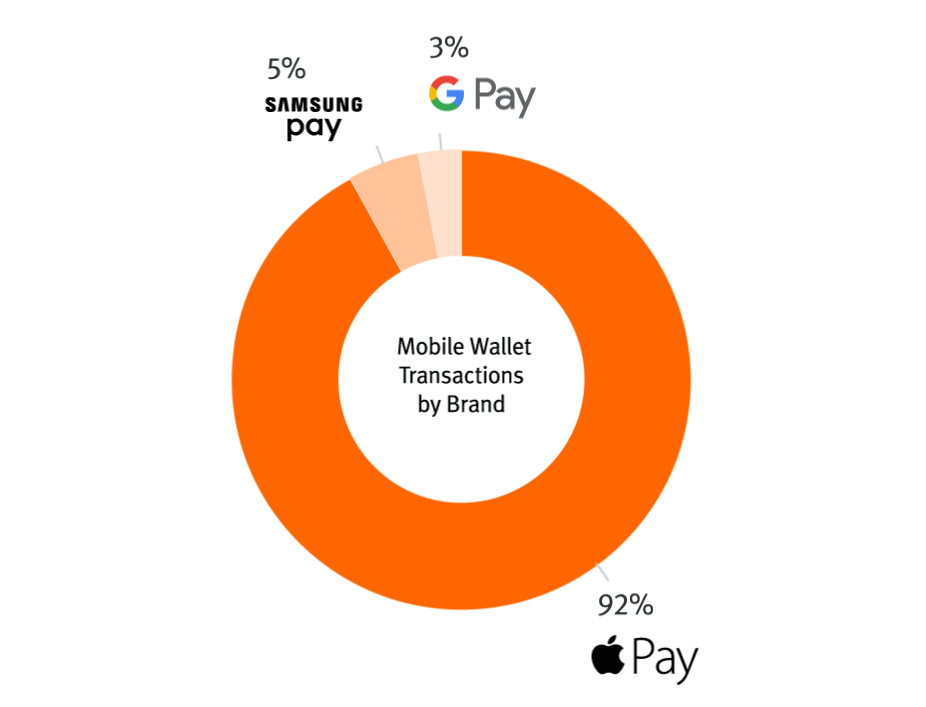

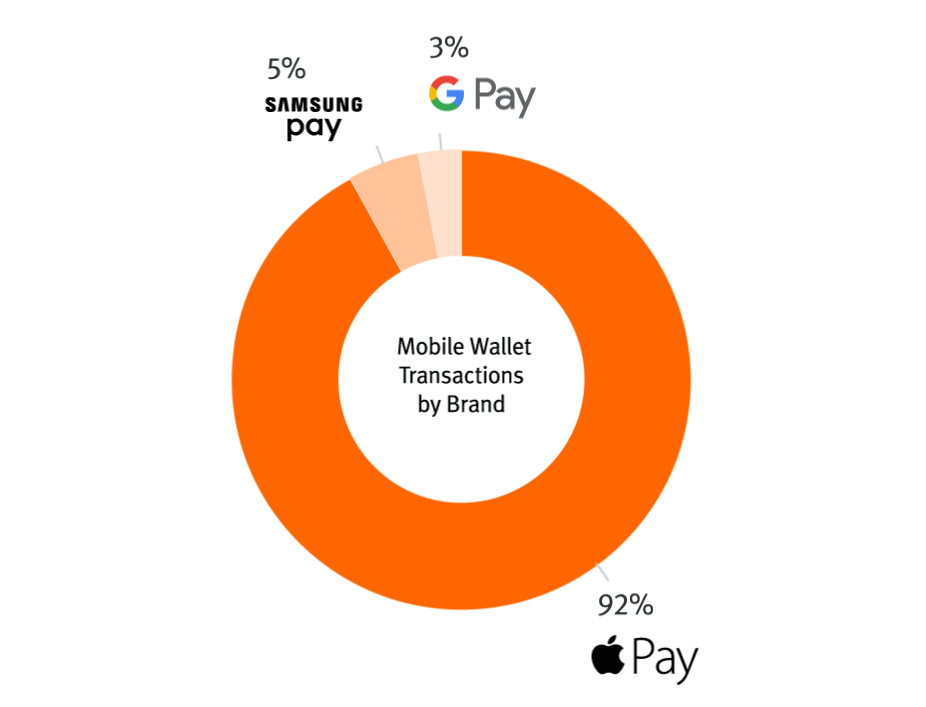

Rolling out the new app was also clunky. Slowly, over a month or two, users were kicked out of the old Google Pay and had to switch to a new app. The new identity system was not backward compatible with the old Google Pay, which meant users still on the old app couldn't send money to users on the new app. According to Pulse Network ( a wing of the Discover card) Google Pay holds 3% of the entire US NFC market. Keep in mind that Google entered this market years before Apple.

Pulse network

According to Pulse Network ( a wing of the Discover card) Google Pay holds 3% of the entire US NFC market. Keep in mind that Google entered this market years before Apple.

Pulse network

The new Google Pay was announced a year into Ready's tenure at Google and launched in March 2021. The app was initially accompanied by big expansion plans, including a wild announcement of branded bank accounts Google. Sengupta left Google a month after the US launch of the new Google Pay, which sparked an "exodus" of employees, according to Insider. The report said "dozens of employees and executives" left the payments team following Sengupta's departure, with one employee saying there was "frustration" that the new Google Pay "wasn't growing." not at the pace we wanted".

What happened next feels like a complete abandonment of the original "New Google Pay" game plan. Google usually launches a product in the United States first and then slowly rolls it out to the rest of the world, but after the initial poor reception, the new Google Pay has never been widely rolled out outside of the United States. Google canceled its heavily promoted plans for a Google Bank Account, even though, according to the Wall Street Journal, the company already had 400,000 curious users on the public waiting list.

Ready appointed a new head of payments in January, a move Bloomberg described as a "reset" to Google's payments strategy. Ready also made headlines at the time saying, "Cryptography is something we pay a lot of attention to," although no Google products emerged.

F...

Enlarge

Sean Gallup | Getty Images

Enlarge

Sean Gallup | Getty Images

Google fired two high-ranking executives this week. The first was Bill Ready, Google's "president of commerce, payments and the next billion users," who left to become CEO of Pinterest. The second big departure is Javier Soltero, who was vice president and general manager of Google Workspace, Google's paid business app, and who ran Google Messaging. Both executives brought big changes to Google during their nearly three-year stints at the company. Now that they're gone, it's unclear what the future of their respective products holds.

Ready only worked at Google for two and a half years, where his most high-profile decision was presiding over the disastrous rollout of a major redesign of Google Pay. The new Google Pay app was spearheaded by Ready's payments team, led by another recently ousted executive, Caesar Sengupta. The redesign of Google Pay brought an app originally developed for India to the United States, where the requirement for a phone number-based identity came with a long list of downgrades: Google Pay's website had to be stripped of payment functionality, the app no longer supported accounts, and you couldn't be signed in to multiple devices.

Rolling out the new app was also clunky. Slowly, over a month or two, users were kicked out of the old Google Pay and had to switch to a new app. The new identity system was not backward compatible with the old Google Pay, which meant users still on the old app couldn't send money to users on the new app. According to Pulse Network ( a wing of the Discover card) Google Pay holds 3% of the entire US NFC market. Keep in mind that Google entered this market years before Apple.

Pulse network

According to Pulse Network ( a wing of the Discover card) Google Pay holds 3% of the entire US NFC market. Keep in mind that Google entered this market years before Apple.

Pulse network

The new Google Pay was announced a year into Ready's tenure at Google and launched in March 2021. The app was initially accompanied by big expansion plans, including a wild announcement of branded bank accounts Google. Sengupta left Google a month after the US launch of the new Google Pay, which sparked an "exodus" of employees, according to Insider. The report said "dozens of employees and executives" left the payments team following Sengupta's departure, with one employee saying there was "frustration" that the new Google Pay "wasn't growing." not at the pace we wanted".

What happened next feels like a complete abandonment of the original "New Google Pay" game plan. Google usually launches a product in the United States first and then slowly rolls it out to the rest of the world, but after the initial poor reception, the new Google Pay has never been widely rolled out outside of the United States. Google canceled its heavily promoted plans for a Google Bank Account, even though, according to the Wall Street Journal, the company already had 400,000 curious users on the public waiting list.

Ready appointed a new head of payments in January, a move Bloomberg described as a "reset" to Google's payments strategy. Ready also made headlines at the time saying, "Cryptography is something we pay a lot of attention to," although no Google products emerged.

F...

What's Your Reaction?