How to beat the market in 2023?

Want to see a stock picking strategy that outperformed the S&P 500 (SPY) by a wide margin in 2022? So read on to appreciate this game changer that should benefit you greatly in 2023 and beyond. Read on for the full story below.

shutterstock.com - StockNews

shutterstock.com - StockNewsThe 2022 bear market has been a serious wake-up call for investors.

The harsh reality is that many of the methods that seemed to work so well in previous years...were downright doomed to death when the bear market came out of hibernation.

First and foremost was the idea of buying “trendy” growth stocks like Roku and Tesla, regardless of nosebleed valuations. This party ended very badly last year.

So if those things don't work... then what does?

That will be the subject of this commentary where I discuss a 3-step evolution in the way of stock picking that has led many people on the path to superior performance. Hopefully this informs a strategy that improves your chances of investing success in the new year.

Stock Selection Method 1.0

In order to give you the solution, I must first report the problem. And that's the imperfect way most of us research stocks. To that end, I'll give you some insight into how the average person handles this vital task...then I'll point you to a better path.

Let's say you're reading an article where an expert touts 3 stocks he thinks are great. From there, we'll likely surf your favorite investing websites for additional information, which is a combination of the following:

What does the company do? (industry sector) Review recent price action Explore a few key metrics on company growth, value, or finances Read additional articles that tell us a bit more about the company's growth story, giving us confidence that this is an attractive investment for the future.So what's wrong with this approach?

First of all, it is very time consuming because you realize that this manual method will be applied to every stock being reviewed.

Second, and most important, you really don't cover that much ground. This means there are literally thousands of data points you can study for each stock to gauge its health...and how it compares to the competition.

Yet, if we're being honest, this antiquated method only leads to a review of 5-10 aspects of a business before deciding to place a trade. It's just not a comprehensive enough review to put the odds in your favor, which leads to...

Stock Selection Method 2.0

The solution is to automate this approach. Like using computer models to analyze more factors of these companies in milliseconds. That's why so many investors have turned to quantitative ratings to find the best stocks.

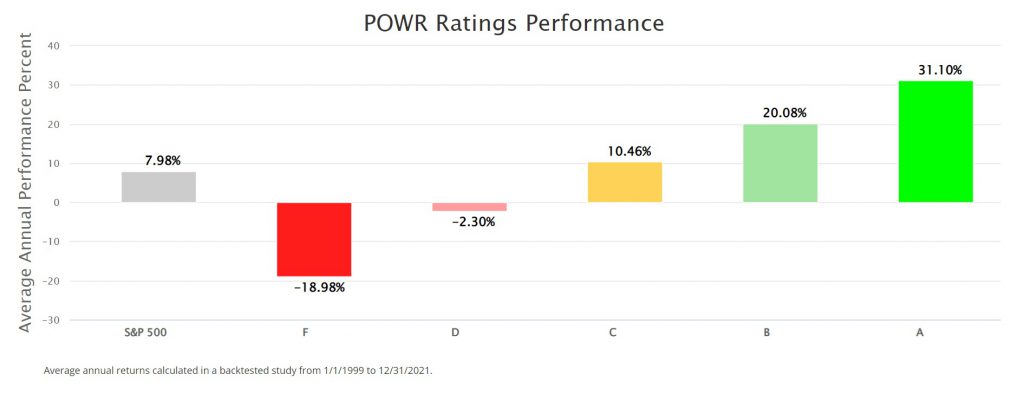

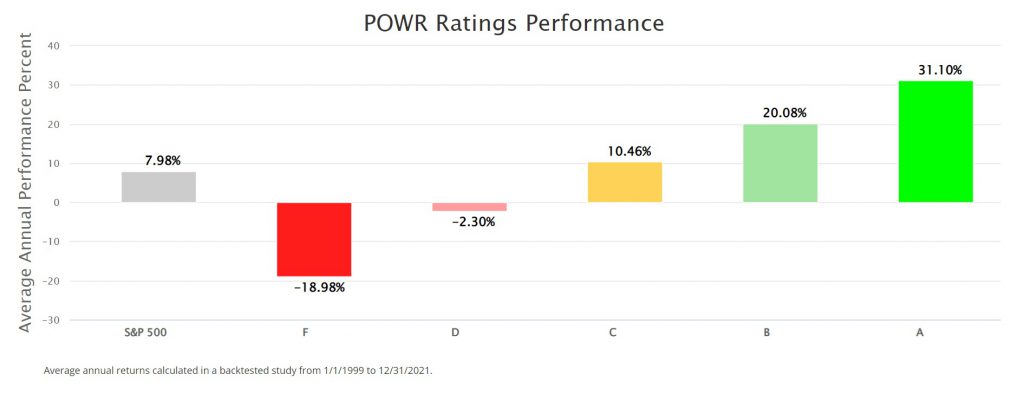

In this area, our proprietary POWR scoring model helps thousands of investors do just that. To analyze each stock against 118 different factors across a range of areas from growth and value to sentiment, momentum, stability and fundamental strength (quality).

Why these 118 factors?

Because the data scientist who created the POWR ratings proved that each of these 118 individual factors leads to stocks that are more likely to outperform the market. So what we say, this model gives you 118 advantages to find stocks that should beat the pack.

The proof of this claim is clearly verified in the following performance chart where our top-rated stocks significantly outperformed the overall market:

Yes, I could end the article here. Because using our POWR ratings will fulfill the promise of this article...to help you find stocks to outperform in the year ahead.

However, there is still one glaring problem to be solved. This is because using the above method will still leave you with around 1,300 buy listed stocks to consider. Just too many for the average person to sort through in a reasonable amount of time. That's why we created...

Stock Selection Method 3.0

As CEO of StockNews.com, I realized that we needed to do more for our customers. Breaking down those 1,300 stocks into a more digestible form so investors can more easily profit from outperformance.

This has resulted in the creation of a series of market-beating newsletters that leverage POWR ratings for major equity investment styles. See the list of newsletters below and the current number of choices in each service to appreciate...

Want to see a stock picking strategy that outperformed the S&P 500 (SPY) by a wide margin in 2022? So read on to appreciate this game changer that should benefit you greatly in 2023 and beyond. Read on for the full story below.

shutterstock.com - StockNews

shutterstock.com - StockNewsThe 2022 bear market has been a serious wake-up call for investors.

The harsh reality is that many of the methods that seemed to work so well in previous years...were downright doomed to death when the bear market came out of hibernation.

First and foremost was the idea of buying “trendy” growth stocks like Roku and Tesla, regardless of nosebleed valuations. This party ended very badly last year.

So if those things don't work... then what does?

That will be the subject of this commentary where I discuss a 3-step evolution in the way of stock picking that has led many people on the path to superior performance. Hopefully this informs a strategy that improves your chances of investing success in the new year.

Stock Selection Method 1.0

In order to give you the solution, I must first report the problem. And that's the imperfect way most of us research stocks. To that end, I'll give you some insight into how the average person handles this vital task...then I'll point you to a better path.

Let's say you're reading an article where an expert touts 3 stocks he thinks are great. From there, we'll likely surf your favorite investing websites for additional information, which is a combination of the following:

What does the company do? (industry sector) Review recent price action Explore a few key metrics on company growth, value, or finances Read additional articles that tell us a bit more about the company's growth story, giving us confidence that this is an attractive investment for the future.So what's wrong with this approach?

First of all, it is very time consuming because you realize that this manual method will be applied to every stock being reviewed.

Second, and most important, you really don't cover that much ground. This means there are literally thousands of data points you can study for each stock to gauge its health...and how it compares to the competition.

Yet, if we're being honest, this antiquated method only leads to a review of 5-10 aspects of a business before deciding to place a trade. It's just not a comprehensive enough review to put the odds in your favor, which leads to...

Stock Selection Method 2.0

The solution is to automate this approach. Like using computer models to analyze more factors of these companies in milliseconds. That's why so many investors have turned to quantitative ratings to find the best stocks.

In this area, our proprietary POWR scoring model helps thousands of investors do just that. To analyze each stock against 118 different factors across a range of areas from growth and value to sentiment, momentum, stability and fundamental strength (quality).

Why these 118 factors?

Because the data scientist who created the POWR ratings proved that each of these 118 individual factors leads to stocks that are more likely to outperform the market. So what we say, this model gives you 118 advantages to find stocks that should beat the pack.

The proof of this claim is clearly verified in the following performance chart where our top-rated stocks significantly outperformed the overall market:

Yes, I could end the article here. Because using our POWR ratings will fulfill the promise of this article...to help you find stocks to outperform in the year ahead.

However, there is still one glaring problem to be solved. This is because using the above method will still leave you with around 1,300 buy listed stocks to consider. Just too many for the average person to sort through in a reasonable amount of time. That's why we created...

Stock Selection Method 3.0

As CEO of StockNews.com, I realized that we needed to do more for our customers. Breaking down those 1,300 stocks into a more digestible form so investors can more easily profit from outperformance.

This has resulted in the creation of a series of market-beating newsletters that leverage POWR ratings for major equity investment styles. See the list of newsletters below and the current number of choices in each service to appreciate...

What's Your Reaction?