How to make money as a business owner in 5 simple steps

Small businesses have many expenses to control. There are team salaries, rent, utilities, suppliers and everything else in between. Because of this, your own salary might become an afterthought.

But it's important that owners pay themselves properly and factor the cost into their budget. Small businesses often have extremely thin profit margins, so if you don't closely monitor your monthly salary and its impact on your cash flow, you could end up in trouble later on.

To help you avoid any problems, we've created this guide on how to compensate yourself as a business owner. We'll show you all the steps and explain how Homebase can help you along the way, so let's get started.

Step 1: Review your business financesYour main concern is probably to find a balance between earning a living wage and not cutting your company's profits too much. So before you make deposits, it's important to review your finances and see how much you can afford.

The statements will give you the best picture of the overall financial health of your business. Check your income statement and find your gross profit to see how much extra money you made last year.

Next, calculate how much you should leave for potential expenses, emergencies, and business growth. You never know when you might need funds to fix a leaky roof or replace a faulty coffee machine.

You can pay yourself from the remaining profits. The exact amount will depend on the specifics of your business, but to give you a ballpark figure, it can range from $30,000 to $130,000 per year, with an average of $69,000.

Step #2: Decide between paying a salary or a drawBusiness owners must also decide how to compensate themselves, either with a salary or with a draw. There's no right answer here: the best way to compensate yourself as a business owner depends on your needs and preferences.

An owner draw allows you to transfer funds from your business account whenever you want. If desired, it can be as regular as a standard paycheck. Here are the main pros and cons:

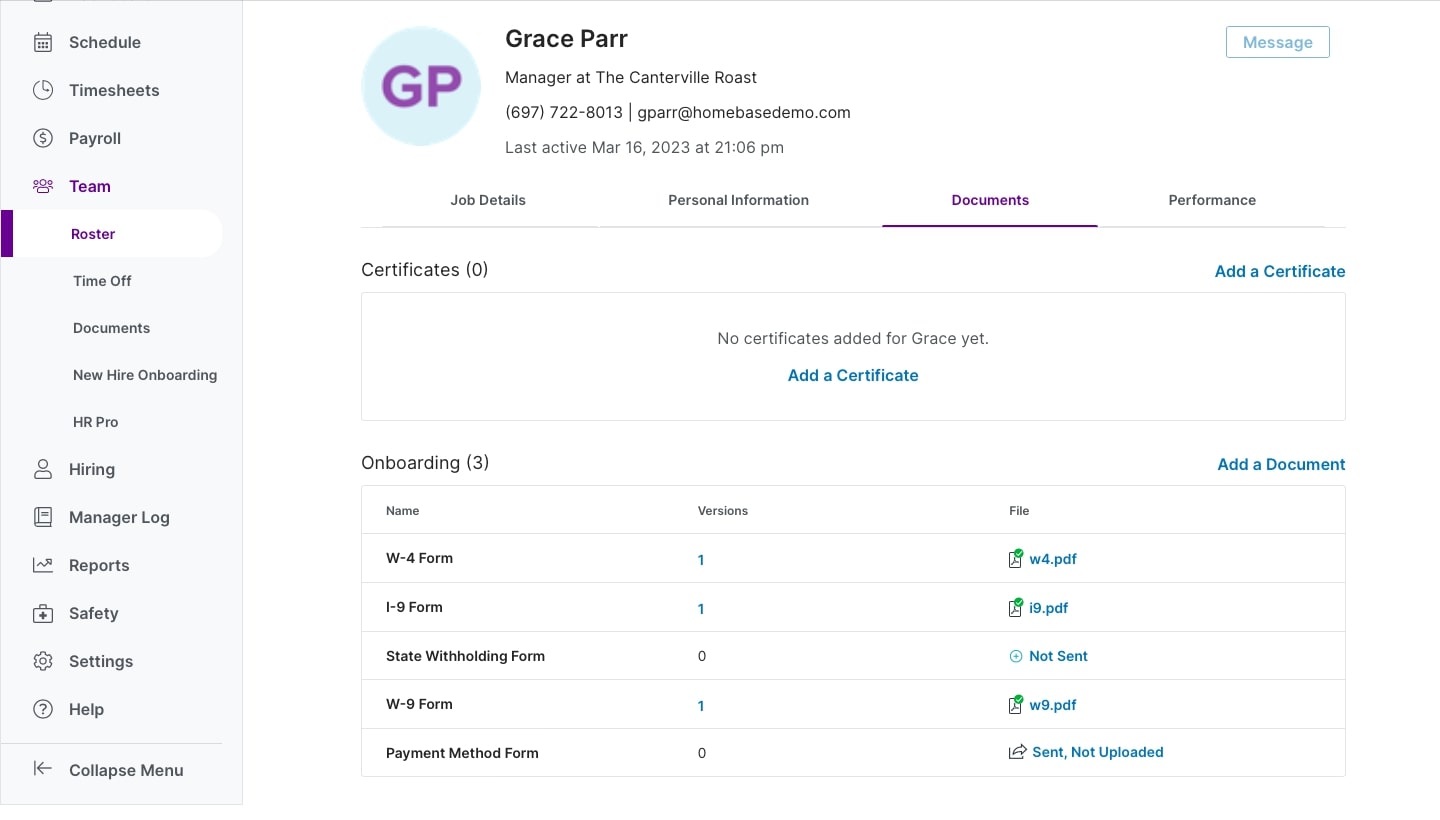

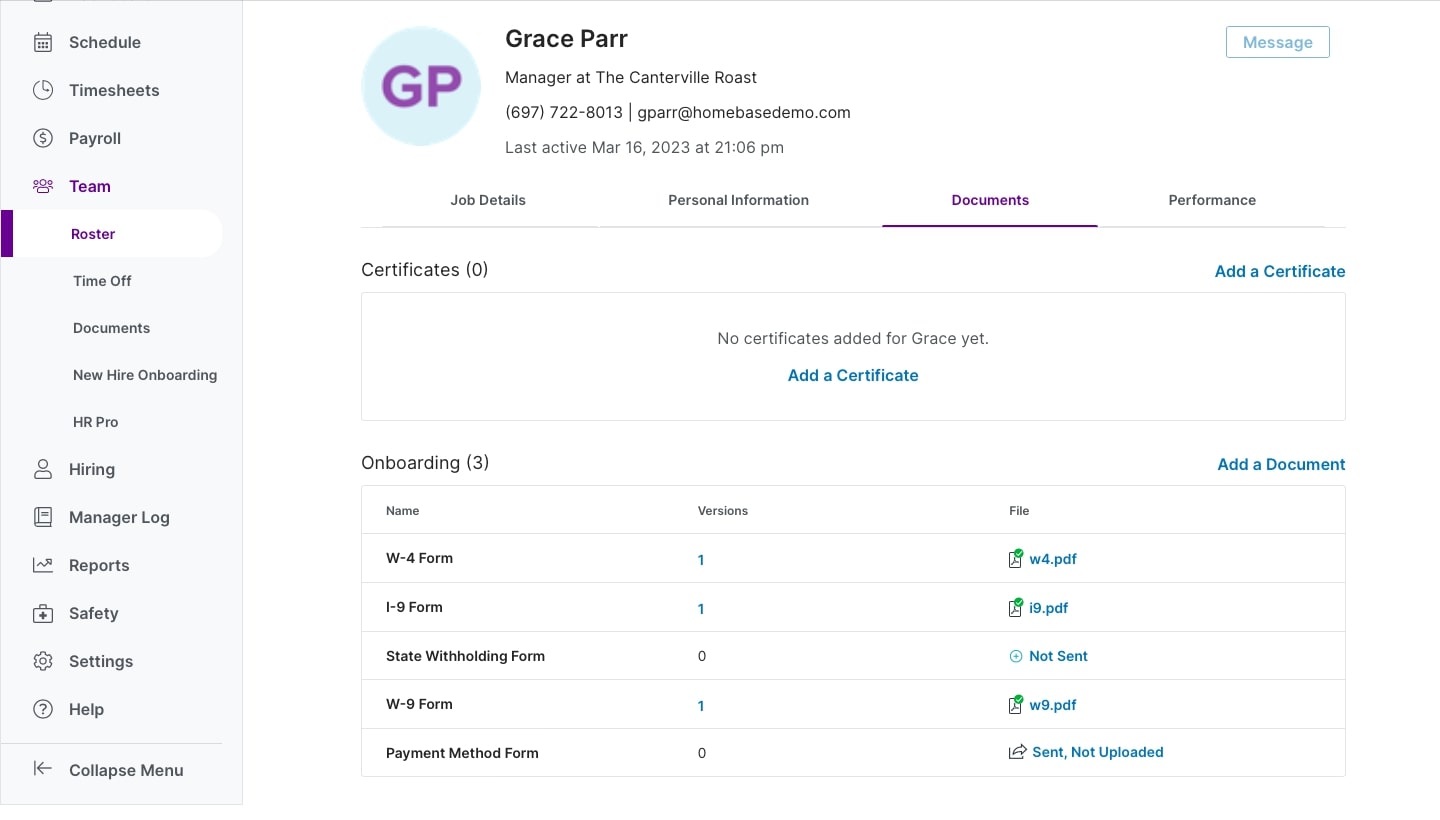

Pros: You can easily change the amount depending on your company's financial situation. Pros: You can get paid instantly. Con: You're responsible for arranging your own withholding, Social Security, and Medicare expenses, which means more paperwork and stress.Paying you a salary means adding yourself to your payroll and receiving a salary each month like the rest of your staff. For example, Homebase's payroll tool allows landlords to establish themselves as W-2 employees and pay themselves that way. Although it's a less flexible method than the coin flip, you can still take pay raises and cuts if your financial situation changes. The pros and cons are:

Pros: Salaries give you a better indication of the overall health of your business – if your payroll system sees you (the owner) as one of your company's regular employees and reports that it can't afford you pay, you have a cash flow problem. Pros: You can treat your salary as a business expense and save on taxes. Disadvantage: If you're unsure of your cash flow, you're more likely to end up underpaid or overpaid.

Deciding when to pay as an owner is almost as important as how much. If you choose the wrong payroll schedule, you could cause cash flow problems, like not leaving enough money to pay a utility bill.

As for prints, you can take...

Small businesses have many expenses to control. There are team salaries, rent, utilities, suppliers and everything else in between. Because of this, your own salary might become an afterthought.

But it's important that owners pay themselves properly and factor the cost into their budget. Small businesses often have extremely thin profit margins, so if you don't closely monitor your monthly salary and its impact on your cash flow, you could end up in trouble later on.

To help you avoid any problems, we've created this guide on how to compensate yourself as a business owner. We'll show you all the steps and explain how Homebase can help you along the way, so let's get started.

Step 1: Review your business financesYour main concern is probably to find a balance between earning a living wage and not cutting your company's profits too much. So before you make deposits, it's important to review your finances and see how much you can afford.

The statements will give you the best picture of the overall financial health of your business. Check your income statement and find your gross profit to see how much extra money you made last year.

Next, calculate how much you should leave for potential expenses, emergencies, and business growth. You never know when you might need funds to fix a leaky roof or replace a faulty coffee machine.

You can pay yourself from the remaining profits. The exact amount will depend on the specifics of your business, but to give you a ballpark figure, it can range from $30,000 to $130,000 per year, with an average of $69,000.

Step #2: Decide between paying a salary or a drawBusiness owners must also decide how to compensate themselves, either with a salary or with a draw. There's no right answer here: the best way to compensate yourself as a business owner depends on your needs and preferences.

An owner draw allows you to transfer funds from your business account whenever you want. If desired, it can be as regular as a standard paycheck. Here are the main pros and cons:

Pros: You can easily change the amount depending on your company's financial situation. Pros: You can get paid instantly. Con: You're responsible for arranging your own withholding, Social Security, and Medicare expenses, which means more paperwork and stress.Paying you a salary means adding yourself to your payroll and receiving a salary each month like the rest of your staff. For example, Homebase's payroll tool allows landlords to establish themselves as W-2 employees and pay themselves that way. Although it's a less flexible method than the coin flip, you can still take pay raises and cuts if your financial situation changes. The pros and cons are:

Pros: Salaries give you a better indication of the overall health of your business – if your payroll system sees you (the owner) as one of your company's regular employees and reports that it can't afford you pay, you have a cash flow problem. Pros: You can treat your salary as a business expense and save on taxes. Disadvantage: If you're unsure of your cash flow, you're more likely to end up underpaid or overpaid.

Deciding when to pay as an owner is almost as important as how much. If you choose the wrong payroll schedule, you could cause cash flow problems, like not leaving enough money to pay a utility bill.

As for prints, you can take...

What's Your Reaction?