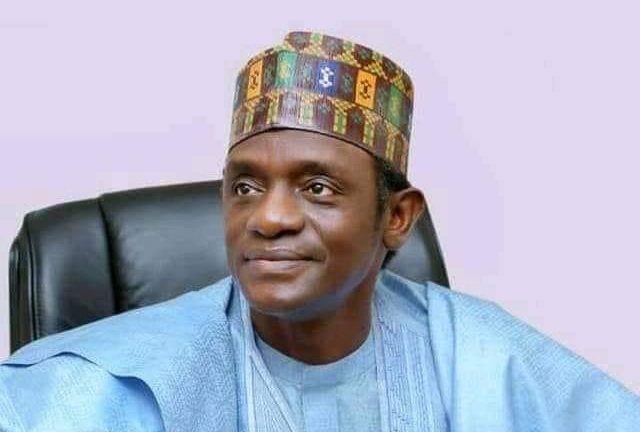

Naira Redesign: Yobe Governor appeals to CBN to extend deadline

Yobe State Governor Mai Buni has appealed to the Central Bank of Nigeria (CBN) to extend the recall period for the old Naira note, saying many people in rural areas of the State will not meet the deadline.< /p>

The CBN's new naira policy states that the old model naira banknotes will no longer be legal tender on January 31. The newly designed notes are expected to replace the old notes from February 1.

Despite appeals from Nigerians, including the Senate, for the CBN to extend the deadline to June 30, the CBN has doubled the original deadline.

Mr. Buni, in a statement through his spokesperson Mamman Mohammed, asked the CBN to make a special concession for the people of the state or make an alternative arrangement, especially for people living in the areas. rural, in order to meet the deadline.

According to the governor, only four of the state's 17 local governments have banking services.

Mr. Buni said the absence of banks in rural areas had even been aggravated by the Boko Haram insurgency. He questioned, however, why banks were reluctant to reopen despite the acquittal of insurgents in the state.

“Some of the banks with branches in local government areas closed branches at the height of Boko Haram’s security challenge, but have yet to reopen despite improved security in the state,” he said.

“The CBN should make sure to provide special services to these areas with special needs to avoid victimizing them and losing their money.

“The CBN and commercial banks should, in the urgent public interest, deploy alternative services at their disposal to save the day.

"As a regulator, the CBN should also ensure that commercial banks open branches at the local government council headquarters now that peace and security are improved across the state," said he said.

"Improved security in Yobe State and the North East is generally prompting banks to resume operations and open new branches in the local government council headquarters and other towns.

"I fear that until something urgent is done, many people may fall victim to not switching to the new notes.

“As a government, we have made these observations earlier, but the challenge is still there and needs the intervention of the Central Bank of Nigeria to salvage the situation,” he said.< /p> READ ALSO: Naira Overhaul: CBN Launches LGA Cash Swap Scheme

PREMIUM TIMES recalls that Mr. Buni had previously expressed similar concern when launching some PoS machines donated to the state government by United Bank for Africa in Damaturu.

At another forum where National Chairman of the Myetti Allah Cattlemen's Association of Nigeria paid a courtesy visit, the Governor also challenged commercial banks to establish more banks in the state and urged cattle ranchers to also embrace modern banking elsewhere to cope with current realities.

Support the integrity and credibility journalism of PREMIUM TIMES

Goes...

Support the integrity and credibility journalism of PREMIUM TIMES

Goes...

Yobe State Governor Mai Buni has appealed to the Central Bank of Nigeria (CBN) to extend the recall period for the old Naira note, saying many people in rural areas of the State will not meet the deadline.< /p>

The CBN's new naira policy states that the old model naira banknotes will no longer be legal tender on January 31. The newly designed notes are expected to replace the old notes from February 1.

Despite appeals from Nigerians, including the Senate, for the CBN to extend the deadline to June 30, the CBN has doubled the original deadline.

Mr. Buni, in a statement through his spokesperson Mamman Mohammed, asked the CBN to make a special concession for the people of the state or make an alternative arrangement, especially for people living in the areas. rural, in order to meet the deadline.

According to the governor, only four of the state's 17 local governments have banking services.

Mr. Buni said the absence of banks in rural areas had even been aggravated by the Boko Haram insurgency. He questioned, however, why banks were reluctant to reopen despite the acquittal of insurgents in the state.

“Some of the banks with branches in local government areas closed branches at the height of Boko Haram’s security challenge, but have yet to reopen despite improved security in the state,” he said.

“The CBN should make sure to provide special services to these areas with special needs to avoid victimizing them and losing their money.

“The CBN and commercial banks should, in the urgent public interest, deploy alternative services at their disposal to save the day.

"As a regulator, the CBN should also ensure that commercial banks open branches at the local government council headquarters now that peace and security are improved across the state," said he said.

"Improved security in Yobe State and the North East is generally prompting banks to resume operations and open new branches in the local government council headquarters and other towns.

"I fear that until something urgent is done, many people may fall victim to not switching to the new notes.

“As a government, we have made these observations earlier, but the challenge is still there and needs the intervention of the Central Bank of Nigeria to salvage the situation,” he said.< /p> READ ALSO: Naira Overhaul: CBN Launches LGA Cash Swap Scheme

PREMIUM TIMES recalls that Mr. Buni had previously expressed similar concern when launching some PoS machines donated to the state government by United Bank for Africa in Damaturu.

At another forum where National Chairman of the Myetti Allah Cattlemen's Association of Nigeria paid a courtesy visit, the Governor also challenged commercial banks to establish more banks in the state and urged cattle ranchers to also embrace modern banking elsewhere to cope with current realities.

Support the integrity and credibility journalism of PREMIUM TIMES

Goes...

Support the integrity and credibility journalism of PREMIUM TIMES

Goes...

What's Your Reaction?