3 Big Reasons Why You Should Consider Covered Call Trades

The combination of cheaper stock prices and more expensive option prices is ideal for a covered call trade on stocks like Apple.

shutterstock.com - StockNews

shutterstock.com - StockNewsStocks have fallen back to their lowest levels of a year ago. Investors are torn over whether this is yet another low or whether stocks could actually drop before rebounding. The VIX is approaching recent highs reflecting this uncertainty.

But rather than wait and see if this is a buying opportunity, savvy investors may consider taking advantage of the current conditions of cheaper stock prices and a higher VIX to effect a lower-risk covered call transaction. Remember that VIX is simply a way of telling the price of options.

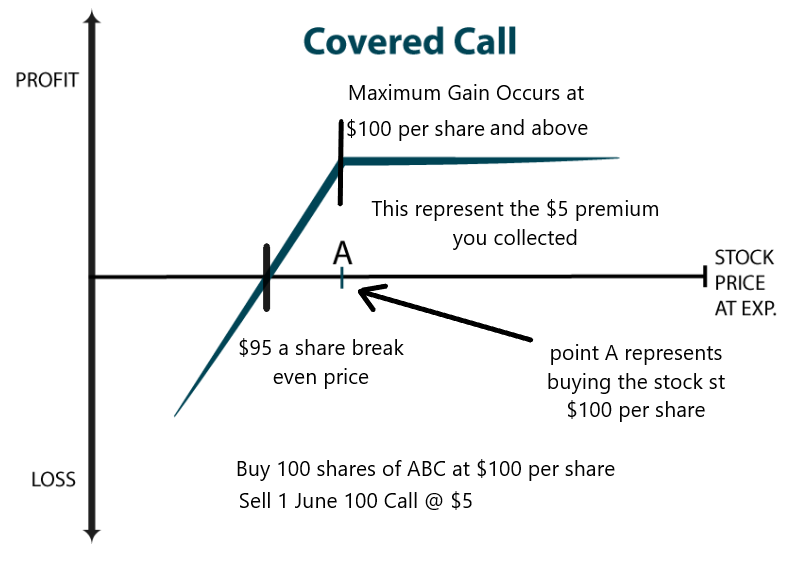

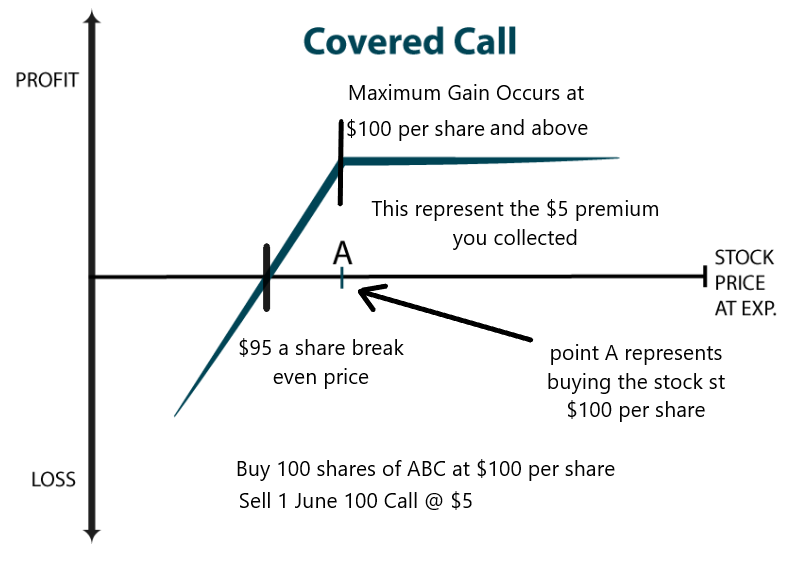

A covered call involves buying 100 shares and simultaneously selling a call option against the stock to reduce the overall cost of the trade. This provides downside protection equal to the amount of call premium received, but limits the upside to the strike price of the sold call option.

This is an ideal trade for those who are neutral to slightly bullish on stocks. Here are three big reasons why this strategy can be a good way to take advantage of more moderate stock market returns in 2023.

Stocks go down/calls go up

Inventories are undoubtedly lower than they were a year ago. The S&P 500 fell more than 20% during this period, while the NASDAQ 100 and Russell 2000 fell further. Implied volatility (IV), which measures the price of options, is significantly higher than it was 12 months ago. The VIX is a well-known and general indicator of option prices on the S&P 500. It has nearly doubled from 16 to 32 in the past 365 days. This means that option prices, both call options and put options, are much more expensive now than they were then.

Making a covered buy stock trade and sell calls benefits from both lower stock prices and higher call prices.

High likely limited

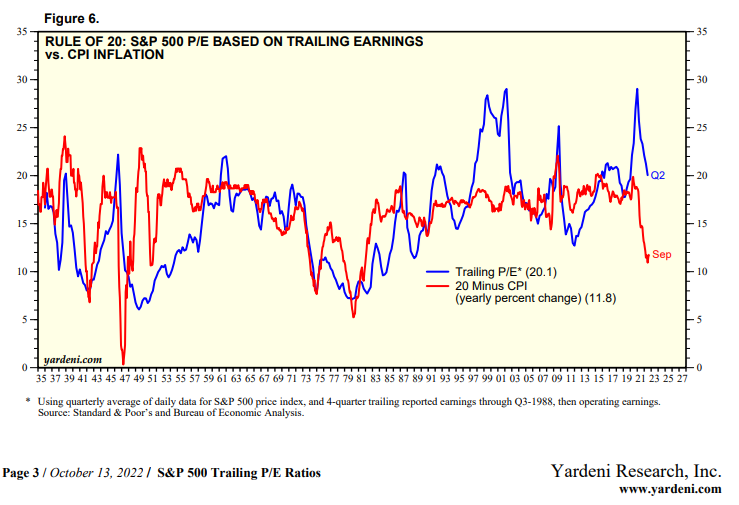

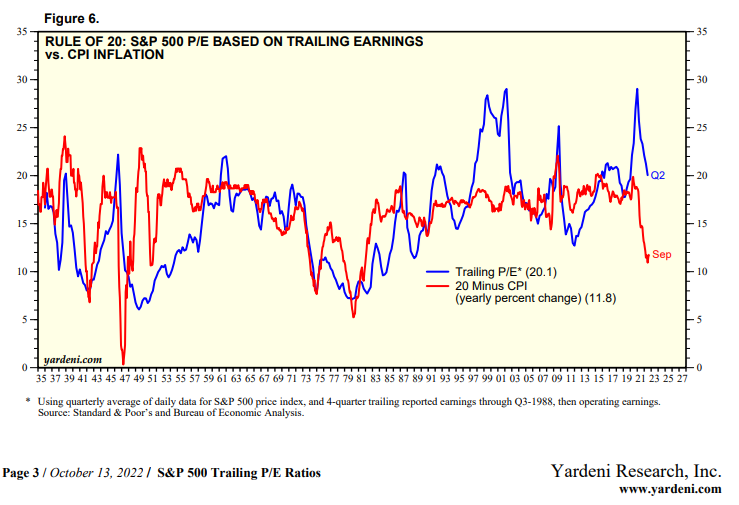

Given the recent run-up in interest rates, valuation multiples will likely be capped for the foreseeable future. The 10-year Treasury yield just closed above 4%, down from well below 2% last year. The consumer price index, or CPI, is at its highest level in 40 years, at more than 8%. The graph below shows how much inflation has increased recently using the rule of 20 (20 minus the CPI rate currently at 8.2%). This rise in inflation and interest rates reduced the P/E from nearly 30 to nearly 20.

With the Fed likely to raise rates again and inflation not expected to slow significantly, P/E multiples should remain somewhat subdued over the coming quarters. This will serve to provide a serious headwind for stock prices in the coming months, making call selling even more beneficial as a hedging mechanism.

Money for nothing

Covered call trades combine long actions and short calls to produce potential profits. If the stock goes up, the long stock position will make a lot of money while the short call position will lose less. Most investors have this idea.

But if the stock position isn't going anywhere, the covered call position will still work pretty well since the short call option will do good as the time premium erodes while the stock that going nowhere remains close to break-even.

The chart above shows how the covered call trade is profitable if the stock remains around the original buy price of $100 per share due to the initial $5 premium received as part of the covered call trade.

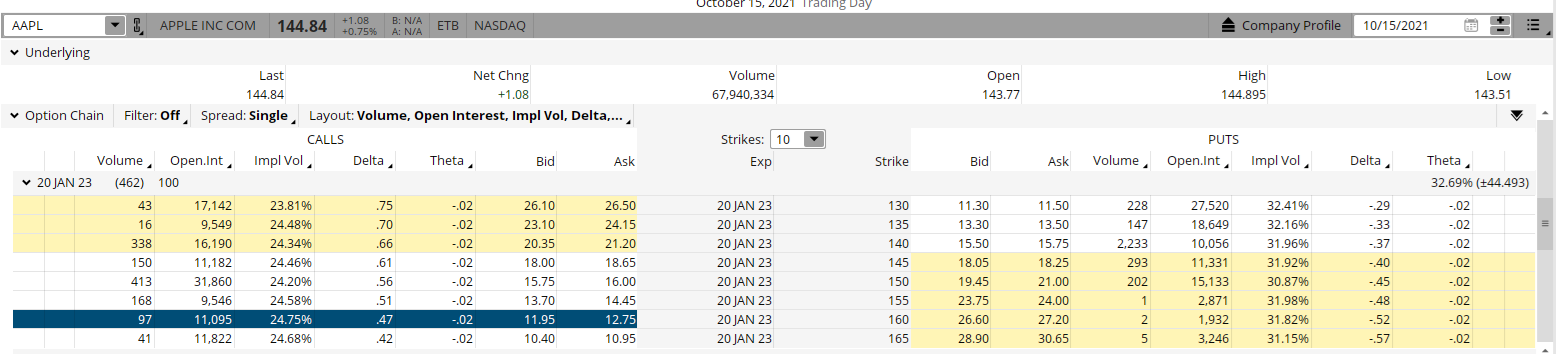

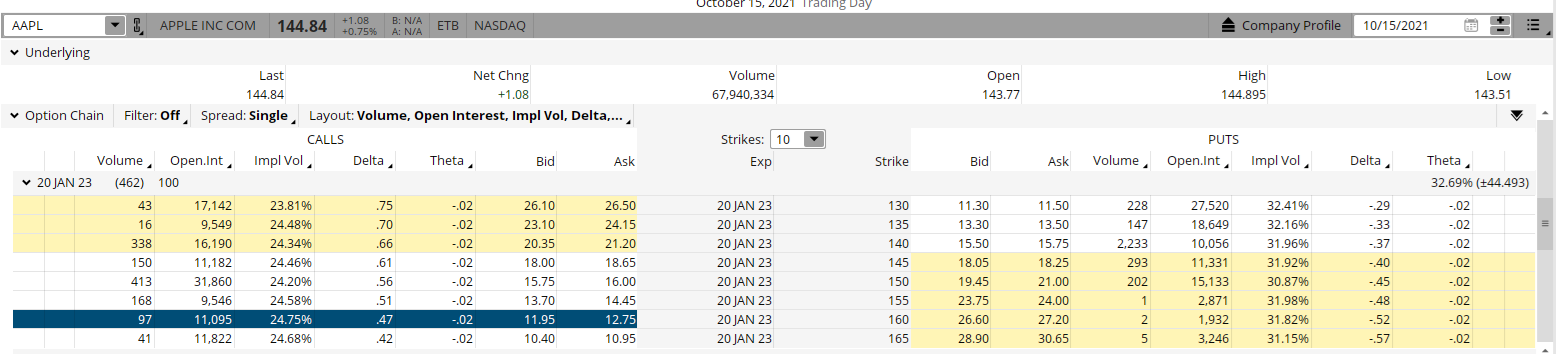

Let's take a walk through a real-time covered call trade on Apple (NASDAQ: AAPL) to see how the recent decline in stock prices and rise in covered call prices can deliver a powerful punch to the covered operator. calling strategy. The same type of justification can be applied in the same way to different stocks or ETFs.

Looking at Apple shares a year ago, we can see that shares closed at $144.84. The January calls at $160 (462 days to expiration) were at $12.35, as seen in the options setup below. Making a covered buy trade of buying AAPL stock and selling a January 160 call would cost $132.49 ($144.84 - $12.35).

Looking at Friday's close, AAPL stock closed at $138.38. The January calls at $160 (462 days to expiration) were at $15.50, as shown in the timeline below. Do I...

The combination of cheaper stock prices and more expensive option prices is ideal for a covered call trade on stocks like Apple.

shutterstock.com - StockNews

shutterstock.com - StockNewsStocks have fallen back to their lowest levels of a year ago. Investors are torn over whether this is yet another low or whether stocks could actually drop before rebounding. The VIX is approaching recent highs reflecting this uncertainty.

But rather than wait and see if this is a buying opportunity, savvy investors may consider taking advantage of the current conditions of cheaper stock prices and a higher VIX to effect a lower-risk covered call transaction. Remember that VIX is simply a way of telling the price of options.

A covered call involves buying 100 shares and simultaneously selling a call option against the stock to reduce the overall cost of the trade. This provides downside protection equal to the amount of call premium received, but limits the upside to the strike price of the sold call option.

This is an ideal trade for those who are neutral to slightly bullish on stocks. Here are three big reasons why this strategy can be a good way to take advantage of more moderate stock market returns in 2023.

Stocks go down/calls go up

Inventories are undoubtedly lower than they were a year ago. The S&P 500 fell more than 20% during this period, while the NASDAQ 100 and Russell 2000 fell further. Implied volatility (IV), which measures the price of options, is significantly higher than it was 12 months ago. The VIX is a well-known and general indicator of option prices on the S&P 500. It has nearly doubled from 16 to 32 in the past 365 days. This means that option prices, both call options and put options, are much more expensive now than they were then.

Making a covered buy stock trade and sell calls benefits from both lower stock prices and higher call prices.

High likely limited

Given the recent run-up in interest rates, valuation multiples will likely be capped for the foreseeable future. The 10-year Treasury yield just closed above 4%, down from well below 2% last year. The consumer price index, or CPI, is at its highest level in 40 years, at more than 8%. The graph below shows how much inflation has increased recently using the rule of 20 (20 minus the CPI rate currently at 8.2%). This rise in inflation and interest rates reduced the P/E from nearly 30 to nearly 20.

With the Fed likely to raise rates again and inflation not expected to slow significantly, P/E multiples should remain somewhat subdued over the coming quarters. This will serve to provide a serious headwind for stock prices in the coming months, making call selling even more beneficial as a hedging mechanism.

Money for nothing

Covered call trades combine long actions and short calls to produce potential profits. If the stock goes up, the long stock position will make a lot of money while the short call position will lose less. Most investors have this idea.

But if the stock position isn't going anywhere, the covered call position will still work pretty well since the short call option will do good as the time premium erodes while the stock that going nowhere remains close to break-even.

The chart above shows how the covered call trade is profitable if the stock remains around the original buy price of $100 per share due to the initial $5 premium received as part of the covered call trade.

Let's take a walk through a real-time covered call trade on Apple (NASDAQ: AAPL) to see how the recent decline in stock prices and rise in covered call prices can deliver a powerful punch to the covered operator. calling strategy. The same type of justification can be applied in the same way to different stocks or ETFs.

Looking at Apple shares a year ago, we can see that shares closed at $144.84. The January calls at $160 (462 days to expiration) were at $12.35, as seen in the options setup below. Making a covered buy trade of buying AAPL stock and selling a January 160 call would cost $132.49 ($144.84 - $12.35).

Looking at Friday's close, AAPL stock closed at $138.38. The January calls at $160 (462 days to expiration) were at $15.50, as shown in the timeline below. Do I...

What's Your Reaction?

![Three of ID's top PR executives quit ad firm Powerhouse [EXCLUSIVE]](https://variety.com/wp-content/uploads/2023/02/ID-PR-Logo.jpg?#)