The bear market is back...

A lot has happened since my comment on the stock market (SPY) last week! We nailed the interest rate hike - 50 basis points, as everyone expected - and I was right that the dot plot and post-meeting commentary would spoil the party. It's definitely been a market where any bad news can send the market tumbling...and that's exactly what we're seeing now. Keep reading for a full update on what's going on….

shutterstock.com - StockNews

shutterstock.com - StockNews(Please enjoy this updated version of my weekly commentary published December 19, 2022 in the POWR Growth newsletter).

Despite all the messages from Fed Chairman Powell that "there is still work to be done" to fight inflation...

Despite all the warnings from economists and CEOs that a recession is likely in our future...

Despite massive layoffs and inverted yield curves...

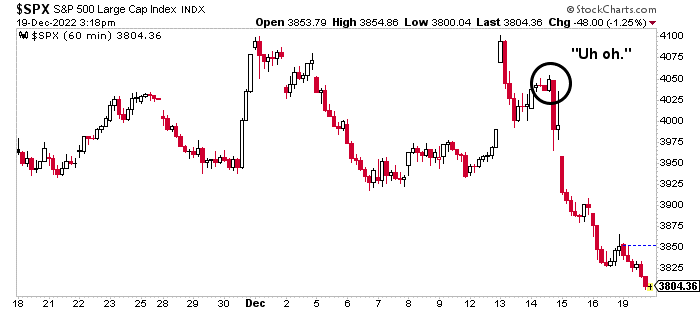

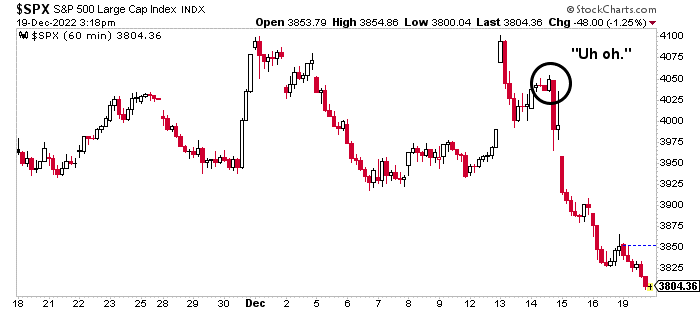

Everyone just realized that next year will be painful. You can see the moment when people came out of the pink haze they lived in.

Since this is an hourly chart, you can really see how the market reacted as traders digested the news.

Including Monday, the S&P 500 (SPY) sold 5% in the four days following Wednesday's rate hike. Looks like Powell woke up the bears.

And yes, the Federal Reserve's latest reality check (more on that shortly) was partly responsible for the decline, but we also had other forces at work.< /p>

But I'm getting ahead of myself. Back to Wednesday, where all this trouble started…

First, the plotting of dots.

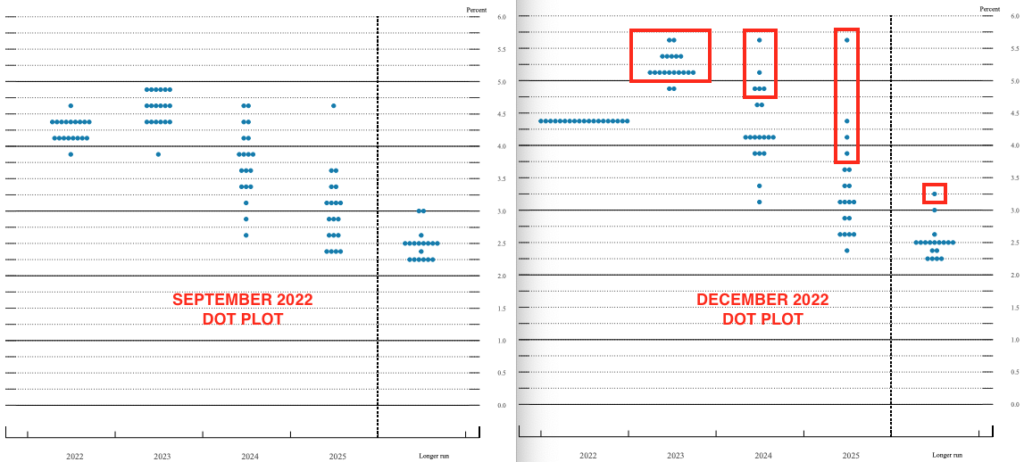

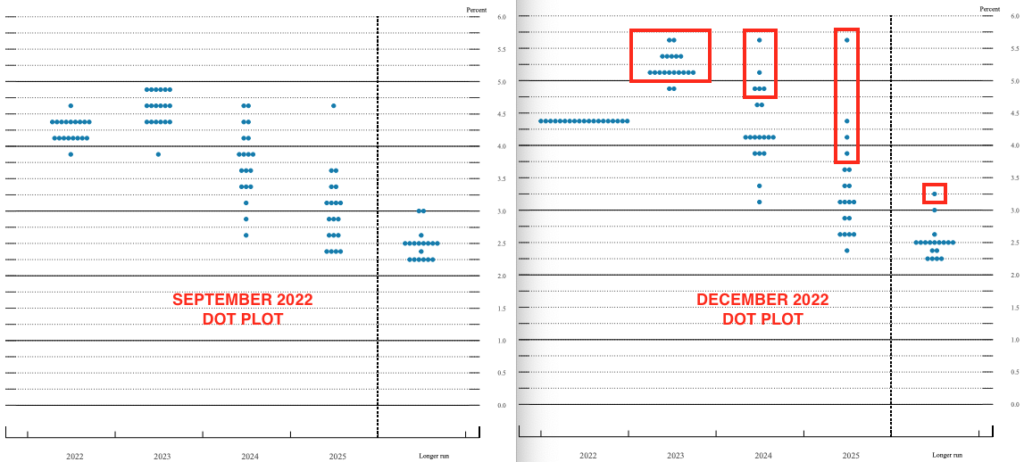

The Fed's "dot chart" is essentially a visual tool that shows where each of the Fed officials thinks interest rates will be in the short, medium, and long term. Here's the September dot chart (left) next to the December 14 meeting (right).

The dots make it clear: a number of Fed officials now think we're going to have to raise rates further…and keep them higher for longer.

When the Fed last released these projections in September, it indicated that the fed funds rate would peak between 4.75% and 5.0% in 2023 before slowly declining in subsequent years.

Now we have significantly more hawkish projections for rates of 5.1% to 5.4% in 2023 (with some Fed officials predicting rates as high as 5.5% to 5.75%) ...staying above 4% through 2024...and possibly going further down in 2025.

(Also, I'd like to know who this super hawk is, predicting interest rates of 5.5% to 5.75% UNTIL 2025. Bold.)

Powell's comments put words to the message painted by the visual: there is still work to be done. A few selected quotes from his post-meeting press conference…

“I would say that we feel today that we are not yet in a sufficiently restrictive policy position, which is why we say that we expect the current hikes to be appropriate.”< /em>

"Historical experience strongly cautions against premature policy easing. I wouldn't see us considering rate cuts until the committee is satisfied that inflation is down to 2% sustainably."

In other words, the Fed is keeping its foot on the accelerator and not letting up until the job is done.

The market ended the day down about 0.6%.

That's a nice drop, but I was expecting a bigger reaction to the increased ferocity and the reminder that the mission was far from complete. However, at this point, I'm used to the market brushing off those bearish headwinds.

And while the Federal Reserve's reality check was partly to blame, new forces were also at work.

Thursday, the European Central Bank and the Bank of England issued their own rate hikes, along with messages that further tightening is likely.

Finally, the US retail sales report showed spending fell in November, not a very promising start to the holiday season. The market reacted accordingly and fell 2.5% on the day.

Friday was more of the same. The S&P 500 fell another 1.1% after news that S&P Global's services PMI fell to a four-month low, while its manufacturing index hit a 31-month low in December .

We saw another notch lower today with the S&P 500 (SPY) closing down 0.9%.

It was a...

A lot has happened since my comment on the stock market (SPY) last week! We nailed the interest rate hike - 50 basis points, as everyone expected - and I was right that the dot plot and post-meeting commentary would spoil the party. It's definitely been a market where any bad news can send the market tumbling...and that's exactly what we're seeing now. Keep reading for a full update on what's going on….

shutterstock.com - StockNews

shutterstock.com - StockNews(Please enjoy this updated version of my weekly commentary published December 19, 2022 in the POWR Growth newsletter).

Despite all the messages from Fed Chairman Powell that "there is still work to be done" to fight inflation...

Despite all the warnings from economists and CEOs that a recession is likely in our future...

Despite massive layoffs and inverted yield curves...

Everyone just realized that next year will be painful. You can see the moment when people came out of the pink haze they lived in.

Since this is an hourly chart, you can really see how the market reacted as traders digested the news.

Including Monday, the S&P 500 (SPY) sold 5% in the four days following Wednesday's rate hike. Looks like Powell woke up the bears.

And yes, the Federal Reserve's latest reality check (more on that shortly) was partly responsible for the decline, but we also had other forces at work.< /p>

But I'm getting ahead of myself. Back to Wednesday, where all this trouble started…

First, the plotting of dots.

The Fed's "dot chart" is essentially a visual tool that shows where each of the Fed officials thinks interest rates will be in the short, medium, and long term. Here's the September dot chart (left) next to the December 14 meeting (right).

The dots make it clear: a number of Fed officials now think we're going to have to raise rates further…and keep them higher for longer.

When the Fed last released these projections in September, it indicated that the fed funds rate would peak between 4.75% and 5.0% in 2023 before slowly declining in subsequent years.

Now we have significantly more hawkish projections for rates of 5.1% to 5.4% in 2023 (with some Fed officials predicting rates as high as 5.5% to 5.75%) ...staying above 4% through 2024...and possibly going further down in 2025.

(Also, I'd like to know who this super hawk is, predicting interest rates of 5.5% to 5.75% UNTIL 2025. Bold.)

Powell's comments put words to the message painted by the visual: there is still work to be done. A few selected quotes from his post-meeting press conference…

“I would say that we feel today that we are not yet in a sufficiently restrictive policy position, which is why we say that we expect the current hikes to be appropriate.”< /em>

"Historical experience strongly cautions against premature policy easing. I wouldn't see us considering rate cuts until the committee is satisfied that inflation is down to 2% sustainably."

In other words, the Fed is keeping its foot on the accelerator and not letting up until the job is done.

The market ended the day down about 0.6%.

That's a nice drop, but I was expecting a bigger reaction to the increased ferocity and the reminder that the mission was far from complete. However, at this point, I'm used to the market brushing off those bearish headwinds.

And while the Federal Reserve's reality check was partly to blame, new forces were also at work.

Thursday, the European Central Bank and the Bank of England issued their own rate hikes, along with messages that further tightening is likely.

Finally, the US retail sales report showed spending fell in November, not a very promising start to the holiday season. The market reacted accordingly and fell 2.5% on the day.

Friday was more of the same. The S&P 500 fell another 1.1% after news that S&P Global's services PMI fell to a four-month low, while its manufacturing index hit a 31-month low in December .

We saw another notch lower today with the S&P 500 (SPY) closing down 0.9%.

It was a...

What's Your Reaction?

![Three of ID's top PR executives quit ad firm Powerhouse [EXCLUSIVE]](https://variety.com/wp-content/uploads/2023/02/ID-PR-Logo.jpg?#)