The bulls in charge…for now at least

Since the S&P 500 (SPY) hit new lows in mid-June, the bulls have regained the upper hand. At first, it looked like your typical bear market rally. However, there are growing signals that this could be the real deal. As in the new bull market may have happened. This topic is important because the outlook, bullish or bearish, weighs heavily on how they build their portfolio for the days and weeks ahead. This is why we will focus on this topic in today's commentary. Read below to find out more….

shutterstock.com - StockNews

shutterstock.com - StockNews(Please enjoy this updated version of my weekly POWR Value newsletter commentary).

Just like George Washington...I can't lie.

I've been downright bearish since mid-May. At first, this strategy paid off, as it hit new lows in mid-June. And since then, being a bear is...unbearable!

In fact, earlier this week during a MoneyShow presentation, I doubled down on my bearish view with this new presentation titled: Bull or Bear...Which Is It?

My goal was to give a balanced view of the bull case versus the bear case. Indeed, there are a few reasons to be bullish. Beyond the obvious ongoing price action, you have signs that...

Inflation could peak No serious dent in job marketSecond quarter earnings season better than expectedISM Services posted a surprising rise last week.

Note that I could spend the next hour poking holes in the bullish arguments above. Instead, I'll just say that for me, the preponderance of evidence always points down.

Because yes, it may be true that we may have avoided a recession so far, but that doesn't mean we will avoid one in the near future with lower prices underway.< /p>

That means inflation may be at its peak...but a drop from 8.7% to just 8.5% shouldn't cause anyone to breathe a big sigh of relief.

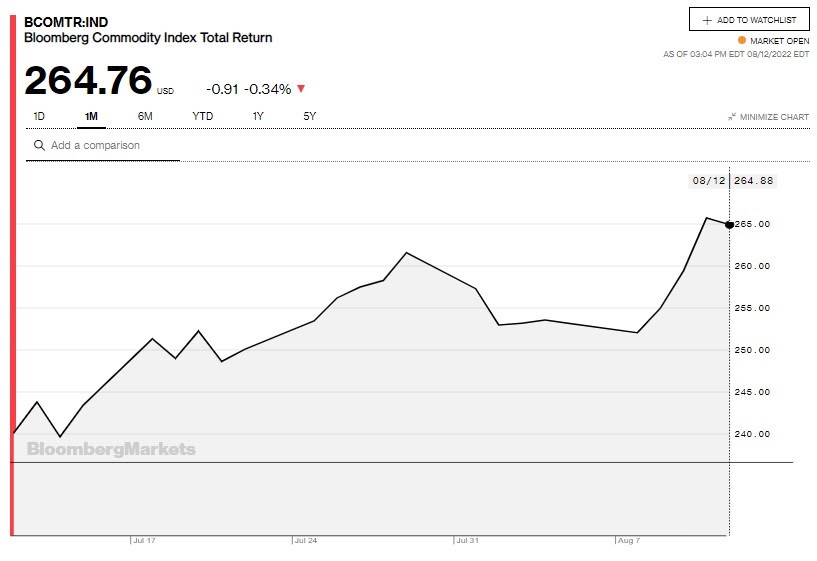

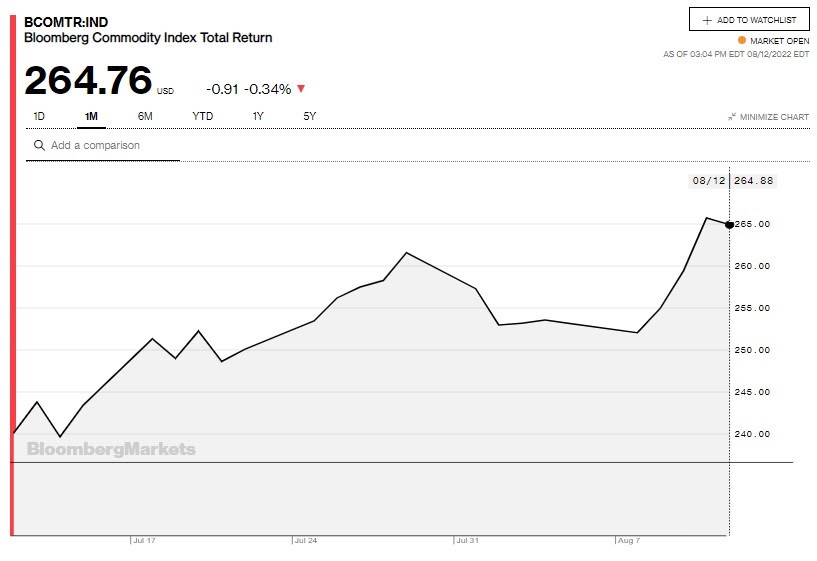

>Especially since this data dates from the end of July. Since then, the commodity index has soared, as you will see below, meaning inflationary pressures are far from gone.

Add in a non-stop parade of Fed officials singing from the same score that looks like this:

We're seriously going to raise the rates...yeah, yeah, yeah

No matter how much it cringes...yeah, yeah, yeah

We just need to keep prices from getting too inflated...yeah, yeah, yeah

(All rights reserved by Reitmeister Economic Sing-A-Long Productions ;-)

As these rates increase, borrowing becomes less attractive. This leads to less investment by companies. This equates to lower expenses.

Typically, this cycle is prolonged by declining profits, job losses and broader economic difficulties. And yes, these would all be telltale signs of recession and bear markets.

For now, it is clear that the bulls are in control. The next real test is at the 200-day moving average currently at 4,328 (about 1% above Friday's close). No doubt there should be some serious resistance at this level which will test investors' conviction.

The more they see the potential negatives blowing away...the more buyers there will be in the stock market (SPY)...the more likely we are to break through 4328 and back to a rally higher new bull market.< /p>

However, if this foreshadowing of a future recession amplifies, investors will first pause this rally to wait for further signals. And the more worrisome the signals...the more stock prices will fall.

You could almost compare it to arm wrestling. Whichever side has stronger evidence will attract investors in its direction.

Again, I see the potential for the next bull market to start now. Just think that...

Since the S&P 500 (SPY) hit new lows in mid-June, the bulls have regained the upper hand. At first, it looked like your typical bear market rally. However, there are growing signals that this could be the real deal. As in the new bull market may have happened. This topic is important because the outlook, bullish or bearish, weighs heavily on how they build their portfolio for the days and weeks ahead. This is why we will focus on this topic in today's commentary. Read below to find out more….

shutterstock.com - StockNews

shutterstock.com - StockNews(Please enjoy this updated version of my weekly POWR Value newsletter commentary).

Just like George Washington...I can't lie.

I've been downright bearish since mid-May. At first, this strategy paid off, as it hit new lows in mid-June. And since then, being a bear is...unbearable!

In fact, earlier this week during a MoneyShow presentation, I doubled down on my bearish view with this new presentation titled: Bull or Bear...Which Is It?

My goal was to give a balanced view of the bull case versus the bear case. Indeed, there are a few reasons to be bullish. Beyond the obvious ongoing price action, you have signs that...

Inflation could peak No serious dent in job marketSecond quarter earnings season better than expectedISM Services posted a surprising rise last week.

Note that I could spend the next hour poking holes in the bullish arguments above. Instead, I'll just say that for me, the preponderance of evidence always points down.

Because yes, it may be true that we may have avoided a recession so far, but that doesn't mean we will avoid one in the near future with lower prices underway.< /p>

That means inflation may be at its peak...but a drop from 8.7% to just 8.5% shouldn't cause anyone to breathe a big sigh of relief.

>Especially since this data dates from the end of July. Since then, the commodity index has soared, as you will see below, meaning inflationary pressures are far from gone.

Add in a non-stop parade of Fed officials singing from the same score that looks like this:

We're seriously going to raise the rates...yeah, yeah, yeah

No matter how much it cringes...yeah, yeah, yeah

We just need to keep prices from getting too inflated...yeah, yeah, yeah

(All rights reserved by Reitmeister Economic Sing-A-Long Productions ;-)

As these rates increase, borrowing becomes less attractive. This leads to less investment by companies. This equates to lower expenses.

Typically, this cycle is prolonged by declining profits, job losses and broader economic difficulties. And yes, these would all be telltale signs of recession and bear markets.

For now, it is clear that the bulls are in control. The next real test is at the 200-day moving average currently at 4,328 (about 1% above Friday's close). No doubt there should be some serious resistance at this level which will test investors' conviction.

The more they see the potential negatives blowing away...the more buyers there will be in the stock market (SPY)...the more likely we are to break through 4328 and back to a rally higher new bull market.< /p>

However, if this foreshadowing of a future recession amplifies, investors will first pause this rally to wait for further signals. And the more worrisome the signals...the more stock prices will fall.

You could almost compare it to arm wrestling. Whichever side has stronger evidence will attract investors in its direction.

Again, I see the potential for the next bull market to start now. Just think that...

What's Your Reaction?

![Three of ID's top PR executives quit ad firm Powerhouse [EXCLUSIVE]](https://variety.com/wp-content/uploads/2023/02/ID-PR-Logo.jpg?#)