How did Main Street restaurants fare in September?

Macroeconomic and geopolitical forces combine to create a negative environment for small and medium-sized businesses. Despite these significant headwinds, there are reasons to be relatively more optimistic for the restaurant industry.

Large flagship companies continue to face and anticipate significant macroeconomic challenges. The CEO of FedEx, for example, now expects a global recession. A host of related forces contribute to this prediction, including slowing consumer spending; higher interest rates; exchange rates that make US exports more expensive; negative wealth effects as assets (e.g. stocks) decline; and changes in business investment Therefore, whether or not we are in a technical recession, economic growth has slowed and will slow relative to trend.

The catering sector has been particularly affected by Covid. However, the industry has made progress in recovering: total restaurant sales fell from $66.3 billion in January 2021 to $86.2 billion in August 2022 (adjusting inflation). Anecdotes of hard-to-get reservations at certain restaurants abound. Additionally, despite significant macro clouds, there are countervailing forces that can lessen the impact of a recession on restaurants by providing alternative sources of demand. These include: Workers are increasingly returning to their desks, which is expected to increase demand for restaurants, cafes and bars that cater to office workers; Increase in the number of domestic and international tourists who, at the moment, are showing an increased appetite for travel; and Employment in the restaurant industry remains well below the pre-pandemic trend line. This suggests that modest demand shocks that might occur during a macroeconomic contraction should have relatively less of an impact on "lean" or short-staffed operations such as restaurants

Recession? Inflation? Stagflation? Conflicting accounts and evidence make it difficult to understand where small and medium-sized restaurants and their employees stand. To help reconcile competing claims, we analyzed employment data for hundreds of thousands of employees working in more than fifty thousand restaurants. Homebase also conducted flash surveys in mid-September and mid-July with more than 100 restaurant owners to understand how they are doing in light of current events.

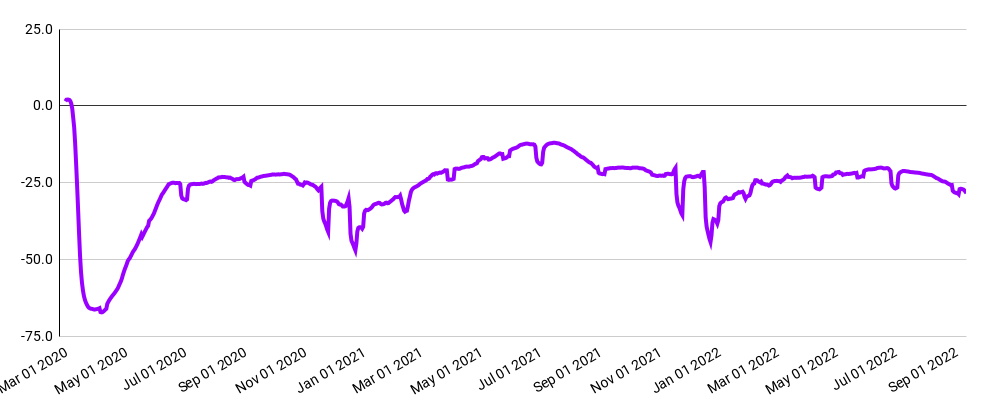

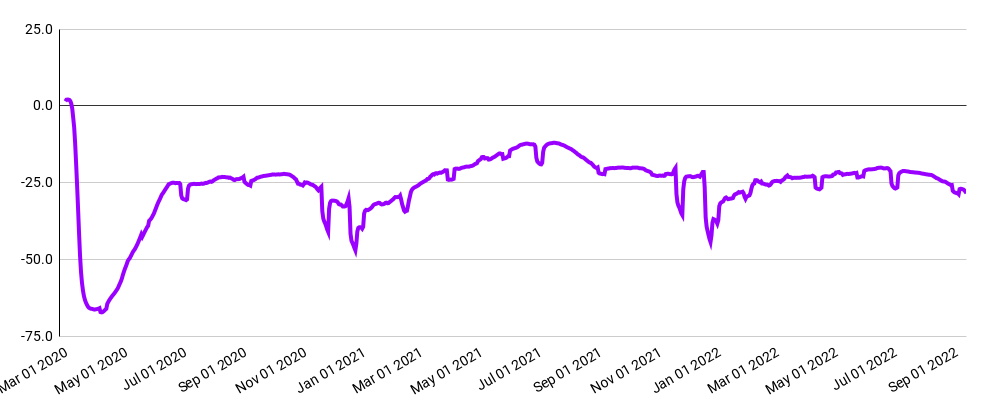

The number of hours worked by restaurant workers in September 2022 is down from September 2021, as well as September 2020, after a relatively robust spring and start to summer

Hours Worked (7-day rolling average; compared to Jan 2020 (i.e. pre-Covid))

Macroeconomic and geopolitical forces combine to create a negative environment for small and medium-sized businesses. Despite these significant headwinds, there are reasons to be relatively more optimistic for the restaurant industry.

Large flagship companies continue to face and anticipate significant macroeconomic challenges. The CEO of FedEx, for example, now expects a global recession. A host of related forces contribute to this prediction, including slowing consumer spending; higher interest rates; exchange rates that make US exports more expensive; negative wealth effects as assets (e.g. stocks) decline; and changes in business investment Therefore, whether or not we are in a technical recession, economic growth has slowed and will slow relative to trend.

The catering sector has been particularly affected by Covid. However, the industry has made progress in recovering: total restaurant sales fell from $66.3 billion in January 2021 to $86.2 billion in August 2022 (adjusting inflation). Anecdotes of hard-to-get reservations at certain restaurants abound. Additionally, despite significant macro clouds, there are countervailing forces that can lessen the impact of a recession on restaurants by providing alternative sources of demand. These include: Workers are increasingly returning to their desks, which is expected to increase demand for restaurants, cafes and bars that cater to office workers; Increase in the number of domestic and international tourists who, at the moment, are showing an increased appetite for travel; and Employment in the restaurant industry remains well below the pre-pandemic trend line. This suggests that modest demand shocks that might occur during a macroeconomic contraction should have relatively less of an impact on "lean" or short-staffed operations such as restaurants

Recession? Inflation? Stagflation? Conflicting accounts and evidence make it difficult to understand where small and medium-sized restaurants and their employees stand. To help reconcile competing claims, we analyzed employment data for hundreds of thousands of employees working in more than fifty thousand restaurants. Homebase also conducted flash surveys in mid-September and mid-July with more than 100 restaurant owners to understand how they are doing in light of current events.

The number of hours worked by restaurant workers in September 2022 is down from September 2021, as well as September 2020, after a relatively robust spring and start to summer

Hours Worked (7-day rolling average; compared to Jan 2020 (i.e. pre-Covid))

What's Your Reaction?

![Three of ID's top PR executives quit ad firm Powerhouse [EXCLUSIVE]](https://variety.com/wp-content/uploads/2023/02/ID-PR-Logo.jpg?#)