How Investors Are Making Millions Amid Volatility

A powerful and rare phenomenon fuels investors' wealth for very brief moments and only for certain stocks.

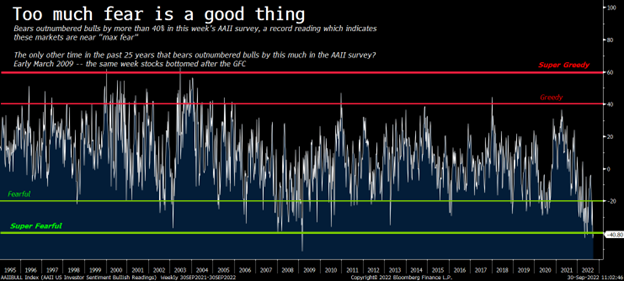

For two weeks in a row, the percentage of bearish investors in America has exceeded the percentage of bullish investors by more than 40%. The last time this happened was early March 2009 - the exact same week that stocks bottomed out after the 2008 financial crisis! My team and I discovered a rare stock market phenomenon that occurs about once every 10 years that consistently represents the best buying opportunities in US stock market history. Whenever these divergences appear, they turn into generational buying opportunities. Stock prices are “returning” to fundamental growth trends, and investors who bought the dip are seeing their returns soar. Because these opportunities emerge from fear in the markets – and because we have reached a peak of fear – we have concluded that this ultra-rare investment opportunity is closing fast.It's been a crazy year in the markets, huh? But what if I told you that all this craziness actually creates the opportunity to win the money of the century?

You'd be skeptical. And it's good. Don't neglect me, because I have a ton of data to prove this claim. Today we are on the cusp of the greatest investment opportunity in the stock market…ever.

Yes, I am aware of all the problems facing the world today. High inflation for decades. A US Federal Reserve embarking on the most aggressive rate hike cycle in over 40 years. A war in Europe for the first time since World War II. Highest gas prices and grocery prices in decades. The biggest stock market crash since 2008.

Talk about unusual, unstable, scary.

In this context, I wouldn't blame you for wanting to run for the hills and get out of the storm. But the great Warren Buffett once said that it's often better to be greedy when others are scared.

Everyone is scared right now.

The American Association of Individual Investors' weekly survey found that for two consecutive weeks, the percentage of bearish investors in the United States exceeded the percentage of bullish investors by more than 40%. This is an unusually high number that marks the "peak of fear". Indeed, the Net Bull Ratio has only been this low once before, in early March 2009 – exactly the same week stocks bottomed after the 2008 financial crisis!

Let that sink in for a moment…

There is nothing but fear. Buffett would tell us to be greedy here. But should we heed this advice?

Absolutely.

Can fear be a good thing?Over the past few months, my team and I have been studying the intricacies of stock market crashes throughout the history of modern capitalism - and we have discovered something amazing.

Specifically, we discovered a rare case that occurs about once every 10 years. And it consistently represents the best buying opportunities in US stock market history.

More than that, we figured out how to quantitatively identify this phenomenon. Yes, we have devised a way to leverage it for massive profits.

Well folks, guess what's going on right now?

This ultra-rare stock phenomenon has appeared. And our models give off "Buy" signals.

I know. This may seem quite counter-intuitive, given what is currently happening in the market.

But I bet my career on it...

A powerful and rare phenomenon fuels investors' wealth for very brief moments and only for certain stocks.

For two weeks in a row, the percentage of bearish investors in America has exceeded the percentage of bullish investors by more than 40%. The last time this happened was early March 2009 - the exact same week that stocks bottomed out after the 2008 financial crisis! My team and I discovered a rare stock market phenomenon that occurs about once every 10 years that consistently represents the best buying opportunities in US stock market history. Whenever these divergences appear, they turn into generational buying opportunities. Stock prices are “returning” to fundamental growth trends, and investors who bought the dip are seeing their returns soar. Because these opportunities emerge from fear in the markets – and because we have reached a peak of fear – we have concluded that this ultra-rare investment opportunity is closing fast.It's been a crazy year in the markets, huh? But what if I told you that all this craziness actually creates the opportunity to win the money of the century?

You'd be skeptical. And it's good. Don't neglect me, because I have a ton of data to prove this claim. Today we are on the cusp of the greatest investment opportunity in the stock market…ever.

Yes, I am aware of all the problems facing the world today. High inflation for decades. A US Federal Reserve embarking on the most aggressive rate hike cycle in over 40 years. A war in Europe for the first time since World War II. Highest gas prices and grocery prices in decades. The biggest stock market crash since 2008.

Talk about unusual, unstable, scary.

In this context, I wouldn't blame you for wanting to run for the hills and get out of the storm. But the great Warren Buffett once said that it's often better to be greedy when others are scared.

Everyone is scared right now.

The American Association of Individual Investors' weekly survey found that for two consecutive weeks, the percentage of bearish investors in the United States exceeded the percentage of bullish investors by more than 40%. This is an unusually high number that marks the "peak of fear". Indeed, the Net Bull Ratio has only been this low once before, in early March 2009 – exactly the same week stocks bottomed after the 2008 financial crisis!

Let that sink in for a moment…

There is nothing but fear. Buffett would tell us to be greedy here. But should we heed this advice?

Absolutely.

Can fear be a good thing?Over the past few months, my team and I have been studying the intricacies of stock market crashes throughout the history of modern capitalism - and we have discovered something amazing.

Specifically, we discovered a rare case that occurs about once every 10 years. And it consistently represents the best buying opportunities in US stock market history.

More than that, we figured out how to quantitatively identify this phenomenon. Yes, we have devised a way to leverage it for massive profits.

Well folks, guess what's going on right now?

This ultra-rare stock phenomenon has appeared. And our models give off "Buy" signals.

I know. This may seem quite counter-intuitive, given what is currently happening in the market.

But I bet my career on it...

What's Your Reaction?

![Three of ID's top PR executives quit ad firm Powerhouse [EXCLUSIVE]](https://variety.com/wp-content/uploads/2023/02/ID-PR-Logo.jpg?#)