How to be like Buffett and buy Berkshire stock at a discount

How to use a covered buy strategy to buy the dip and sell the tear on Warren Buffett's latest buy in Taiwan Semiconductor (TSM).

shutterstock.com - StockNews

shutterstock.com - StockNewsBerkshire Hathaway (BRK.B) disclosed last quarter that it had purchased a large stake in shares of Taiwan Semiconductor (TSM). What size ? How about just over 60 million shares at just under $69 per share. This equates to an outlay of around $4.1 billion for Berkshire and famed Chairman and CEO Warren Buffett.

The announcement of the acquisition on November 15 sent TSM stock up more than 10% on the day. The shares went from under $73 before the announcement to over $80 after the announcement. Taiwan Semiconductor has since pulled back somewhat into the $78 area.

Buying shares of Taiwan Semi at current levels means paying near the highest price TSM has been in several months. It is also well above the price Mr. Buffett paid for his large stake in the company.

Fortunately, a covered call strategy offers a way to get into TSM stock at a discount close to Buffett's buy price while pre-positioning yourself to be a short of the stock during a big upward movement.

A covered call involves buying 100 shares of the underlying stock and simultaneously selling a call option against those shares. It is sometimes called buying and selling since it involves buying stocks and selling call options.

In effect, you receive the premium for the sold call option to help reduce the net cost of the transaction and provide a downside cushion. That's the good part.

To have a much lower initial cost on the trade, however, your advantage is capped at the strike price of the sold call.

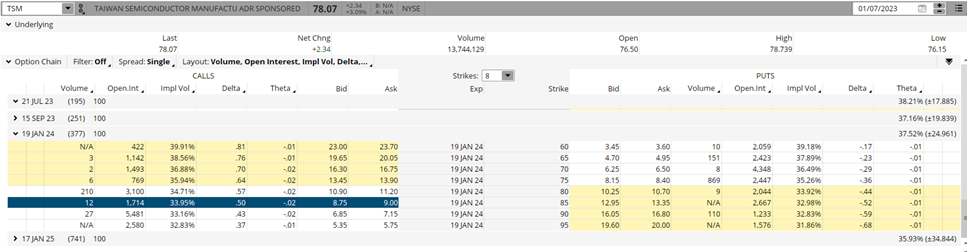

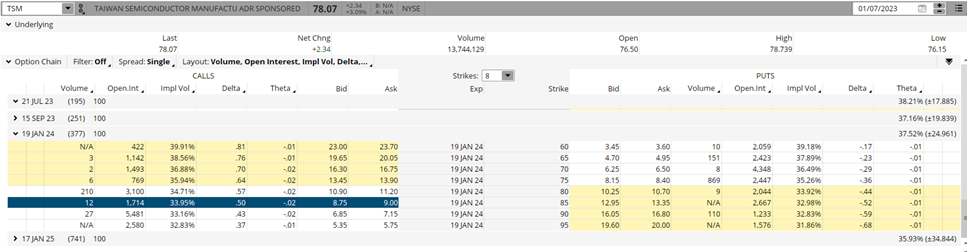

An example of a covered stock strategy on TSM stock would be to buy stocks at current prices ($78.10) and sell the January $85 calls at $8.80 to reduce the cost of the purchase of shares of the amount of the purchase sale.

The table below shows that selling the TSM Jan $85 call reduces the purchase price net of the premium received for selling the call by $8.80. This puts the net cost of the trade at $69.30 ($78.10 minus $8.80), providing an 11.27% downside cushion to breakeven on the stock.

![]()

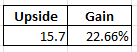

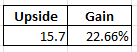

Of course, there is no free lunch in trading. The upside is limited to the strike price of the sold covered call of $85. This, however, still leaves a potential upside gain of $15.70 (short strike price of $85 minus initial cost of $69.30). This equates to a potential gain of 22.66% on the trade if the stock closes above $85 at the January 19, 2024 expiry.

This trade certainly fits into Warren Buffett's philosophy of being afraid when others are greedy and greedy when others are afraid. You are ready to be a buyer of TSM shares on an 11.27% drop when others would probably be scared. You're also ready to sell TSM on a 22.66% rally when others would likely be greedy.

Additionally, TSM has a strong dividend yield of 1.83% and a low payout ratio of around 25%, which would further increase overall return or reduce risk for call option trading covered.

Investors can use different warnings or expiry months to sell depending on their risk/reward profile. Selling lower strike calls would bring more premium to reduce risk on the trade, but it would also reduce yield.

2022 has been a tough year for equities. The S&P 500 fell 19% while the NASDAQ 100 did even worse. Luckily, my POWR options program returned well over 50%.

Many experts expect a challenging market environment in 2023. Investors and traders looking to hedge against the downside while still allowing for a realistic upside would be wise to consider a covered call strategy based on options.

POWR options

What to do next?

If you are looking for the best options trades for today's market, you should check out our latest overview How to Trade Options with POWR Ratings. Here we show you how to consistently find the best options trades, while mini...

How to use a covered buy strategy to buy the dip and sell the tear on Warren Buffett's latest buy in Taiwan Semiconductor (TSM).

shutterstock.com - StockNews

shutterstock.com - StockNewsBerkshire Hathaway (BRK.B) disclosed last quarter that it had purchased a large stake in shares of Taiwan Semiconductor (TSM). What size ? How about just over 60 million shares at just under $69 per share. This equates to an outlay of around $4.1 billion for Berkshire and famed Chairman and CEO Warren Buffett.

The announcement of the acquisition on November 15 sent TSM stock up more than 10% on the day. The shares went from under $73 before the announcement to over $80 after the announcement. Taiwan Semiconductor has since pulled back somewhat into the $78 area.

Buying shares of Taiwan Semi at current levels means paying near the highest price TSM has been in several months. It is also well above the price Mr. Buffett paid for his large stake in the company.

Fortunately, a covered call strategy offers a way to get into TSM stock at a discount close to Buffett's buy price while pre-positioning yourself to be a short of the stock during a big upward movement.

A covered call involves buying 100 shares of the underlying stock and simultaneously selling a call option against those shares. It is sometimes called buying and selling since it involves buying stocks and selling call options.

In effect, you receive the premium for the sold call option to help reduce the net cost of the transaction and provide a downside cushion. That's the good part.

To have a much lower initial cost on the trade, however, your advantage is capped at the strike price of the sold call.

An example of a covered stock strategy on TSM stock would be to buy stocks at current prices ($78.10) and sell the January $85 calls at $8.80 to reduce the cost of the purchase of shares of the amount of the purchase sale.

The table below shows that selling the TSM Jan $85 call reduces the purchase price net of the premium received for selling the call by $8.80. This puts the net cost of the trade at $69.30 ($78.10 minus $8.80), providing an 11.27% downside cushion to breakeven on the stock.

![]()

Of course, there is no free lunch in trading. The upside is limited to the strike price of the sold covered call of $85. This, however, still leaves a potential upside gain of $15.70 (short strike price of $85 minus initial cost of $69.30). This equates to a potential gain of 22.66% on the trade if the stock closes above $85 at the January 19, 2024 expiry.

This trade certainly fits into Warren Buffett's philosophy of being afraid when others are greedy and greedy when others are afraid. You are ready to be a buyer of TSM shares on an 11.27% drop when others would probably be scared. You're also ready to sell TSM on a 22.66% rally when others would likely be greedy.

Additionally, TSM has a strong dividend yield of 1.83% and a low payout ratio of around 25%, which would further increase overall return or reduce risk for call option trading covered.

Investors can use different warnings or expiry months to sell depending on their risk/reward profile. Selling lower strike calls would bring more premium to reduce risk on the trade, but it would also reduce yield.

2022 has been a tough year for equities. The S&P 500 fell 19% while the NASDAQ 100 did even worse. Luckily, my POWR options program returned well over 50%.

Many experts expect a challenging market environment in 2023. Investors and traders looking to hedge against the downside while still allowing for a realistic upside would be wise to consider a covered call strategy based on options.

POWR options

What to do next?

If you are looking for the best options trades for today's market, you should check out our latest overview How to Trade Options with POWR Ratings. Here we show you how to consistently find the best options trades, while mini...

What's Your Reaction?

![Three of ID's top PR executives quit ad firm Powerhouse [EXCLUSIVE]](https://variety.com/wp-content/uploads/2023/02/ID-PR-Logo.jpg?#)