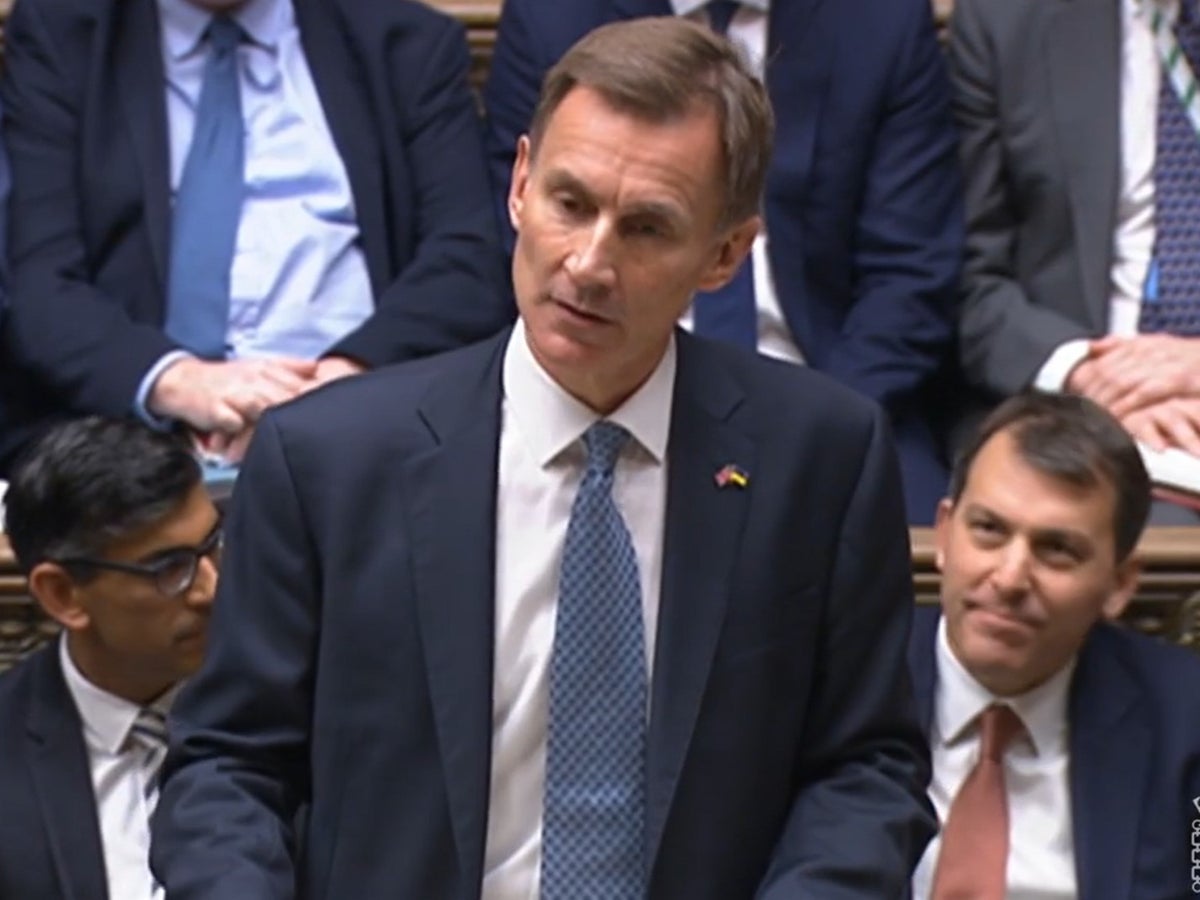

Jeremy Hunt raises windfall energy revenue tax in budget to raise another £14bn

For free real-time news alerts sent directly in your inbox Sign up for our news emailsSign up for our free news emailsPlease enter a valid email addressPlease enter a valid email addressI would like to receive emails about offers , events and updates from The Independent. Read our privacy notice{{ #verifyErrors }}{{ message }}{{ /verifyErrors }}{{ ^verifyErrors }}An error has occurred. Please try again later{{ /verifyErrors }}

For free real-time news alerts sent directly in your inbox Sign up for our news emailsSign up for our free news emailsPlease enter a valid email addressPlease enter a valid email addressI would like to receive emails about offers , events and updates from The Independent. Read our privacy notice{{ #verifyErrors }}{{ message }}{{ /verifyErrors }}{{ ^verifyErrors }}An error has occurred. Please try again later{{ /verifyErrors }}

The government will raise an additional £14 billion next year by raising the energy windfall tax, Jeremy Hunt has announced.

In his first autumn statement as Chancellor, he said the Energy Profits Tax, as it is known, will increase from 25% to 35%.

The move follows months of pressure from Labor for ministers to raise more money from oil and gas giants.

Mr. Hunt told MPs he had "no objection" to windfall taxes if they were genuinely about windfall profits caused by unexpected increases in energy prices.

“But such a tax should be temporary, not discourage investment and recognize the cyclical nature of many energy companies,” he said.

He also announced an exceptional tax on electricity producers of 45%. The move means wind farms in UK waters will pay a higher windfall tax than neighboring oil and gas rigs. Together the two taxes will raise £14 billion next year, Mr Hunt said.

Announcing his plans, he told MPs the OBR thinks the UK is in a recession. He said he was providing a "balanced path to stability" that involves "making tough decisions".

But "anyone who says there are easy answers is not directly with the Brits: some are advocating for spending cuts, but that would not be compatible with quality public services.

His first job was to be to fight inflation which is "eating the pound into the pockets people even more insidiously than taxes," he said.

But Shadow Chancellor Rachel Reeves said that after months of resistance the government had "finally been kicked and cries to extend the windfall tax that Labor first called for in January".

"The government has announced plans for energy bills next year, but the proposed law "Taxpayers will see them rise again next spring, leaving far too many of people wondering how they are going to make ends meet. For every pound of windfall tax left on the table, workers are being forced to pay the price," she said.

Treasury Secretary John Glen later said that he 'did not accept' that the Government had replicated Labor policy on the windfall tax.

Green MP Caroline Lucas welcomed the windfall tax hike, but said she was “scandalous” that the Chancellor “maintains the investment allowance, g...

For free real-time news alerts sent directly in your inbox Sign up for our news emailsSign up for our free news emailsPlease enter a valid email addressPlease enter a valid email addressI would like to receive emails about offers , events and updates from The Independent. Read our privacy notice{{ #verifyErrors }}{{ message }}{{ /verifyErrors }}{{ ^verifyErrors }}An error has occurred. Please try again later{{ /verifyErrors }}

For free real-time news alerts sent directly in your inbox Sign up for our news emailsSign up for our free news emailsPlease enter a valid email addressPlease enter a valid email addressI would like to receive emails about offers , events and updates from The Independent. Read our privacy notice{{ #verifyErrors }}{{ message }}{{ /verifyErrors }}{{ ^verifyErrors }}An error has occurred. Please try again later{{ /verifyErrors }}The government will raise an additional £14 billion next year by raising the energy windfall tax, Jeremy Hunt has announced.

In his first autumn statement as Chancellor, he said the Energy Profits Tax, as it is known, will increase from 25% to 35%.

The move follows months of pressure from Labor for ministers to raise more money from oil and gas giants.

Mr. Hunt told MPs he had "no objection" to windfall taxes if they were genuinely about windfall profits caused by unexpected increases in energy prices.

“But such a tax should be temporary, not discourage investment and recognize the cyclical nature of many energy companies,” he said.

He also announced an exceptional tax on electricity producers of 45%. The move means wind farms in UK waters will pay a higher windfall tax than neighboring oil and gas rigs. Together the two taxes will raise £14 billion next year, Mr Hunt said.

Announcing his plans, he told MPs the OBR thinks the UK is in a recession. He said he was providing a "balanced path to stability" that involves "making tough decisions".

But "anyone who says there are easy answers is not directly with the Brits: some are advocating for spending cuts, but that would not be compatible with quality public services.

His first job was to be to fight inflation which is "eating the pound into the pockets people even more insidiously than taxes," he said.

But Shadow Chancellor Rachel Reeves said that after months of resistance the government had "finally been kicked and cries to extend the windfall tax that Labor first called for in January".

"The government has announced plans for energy bills next year, but the proposed law "Taxpayers will see them rise again next spring, leaving far too many of people wondering how they are going to make ends meet. For every pound of windfall tax left on the table, workers are being forced to pay the price," she said.

Treasury Secretary John Glen later said that he 'did not accept' that the Government had replicated Labor policy on the windfall tax.

Green MP Caroline Lucas welcomed the windfall tax hike, but said she was “scandalous” that the Chancellor “maintains the investment allowance, g...

What's Your Reaction?

![Three of ID's top PR executives quit ad firm Powerhouse [EXCLUSIVE]](https://variety.com/wp-content/uploads/2023/02/ID-PR-Logo.jpg?#)