Jeremy Hunt said to 'clean up' the economic cost of non-dom tax status

Sign up for Inside Politics email for your briefing free daily on the biggest stories in British politicsGet our free Inside Politics emailPlease enter a valid email addressPlease enter a valid email addressI would like to be notified by email about offers, events and updates from The Independent. Read our privacy notice{{ #verifyErrors }}{{ message }}{{ /verifyErrors }}{{ ^verifyErrors }}An error has occurred. Please try again later{{ /verifyErrors }}

Sign up for Inside Politics email for your briefing free daily on the biggest stories in British politicsGet our free Inside Politics emailPlease enter a valid email addressPlease enter a valid email addressI would like to be notified by email about offers, events and updates from The Independent. Read our privacy notice{{ #verifyErrors }}{{ message }}{{ /verifyErrors }}{{ ^verifyErrors }}An error has occurred. Please try again later{{ /verifyErrors }}

Ministers have been told to 'clean up' the economic case for the decision not to scrap UK non-dom status, after the Chancellor hinted that he did not know how much the money that would remove the controversial tax status would rise.

Jeremy Hunt has insisted scrapping the controversial tax status won't help the economy, saying on Friday he'd rather the super-rich 'stay...and spend their money' here". And he said Treasury officials had told him they were "very uncertain" how much money the move would actually bring in.

Labour has now called on ministers to release numbers on how many non-doms there. are in the UK, and the amount the Treasury is currently losing through the loophole.

The highly respected Institute for Fiscal Studies (IFS) think tank told The Independent that its "best estimate" was that abolishing the measure would bring around £3 billion a year. The figure is roughly the same amount announced by Mr Hunt that will be added to next year's NHS budget.

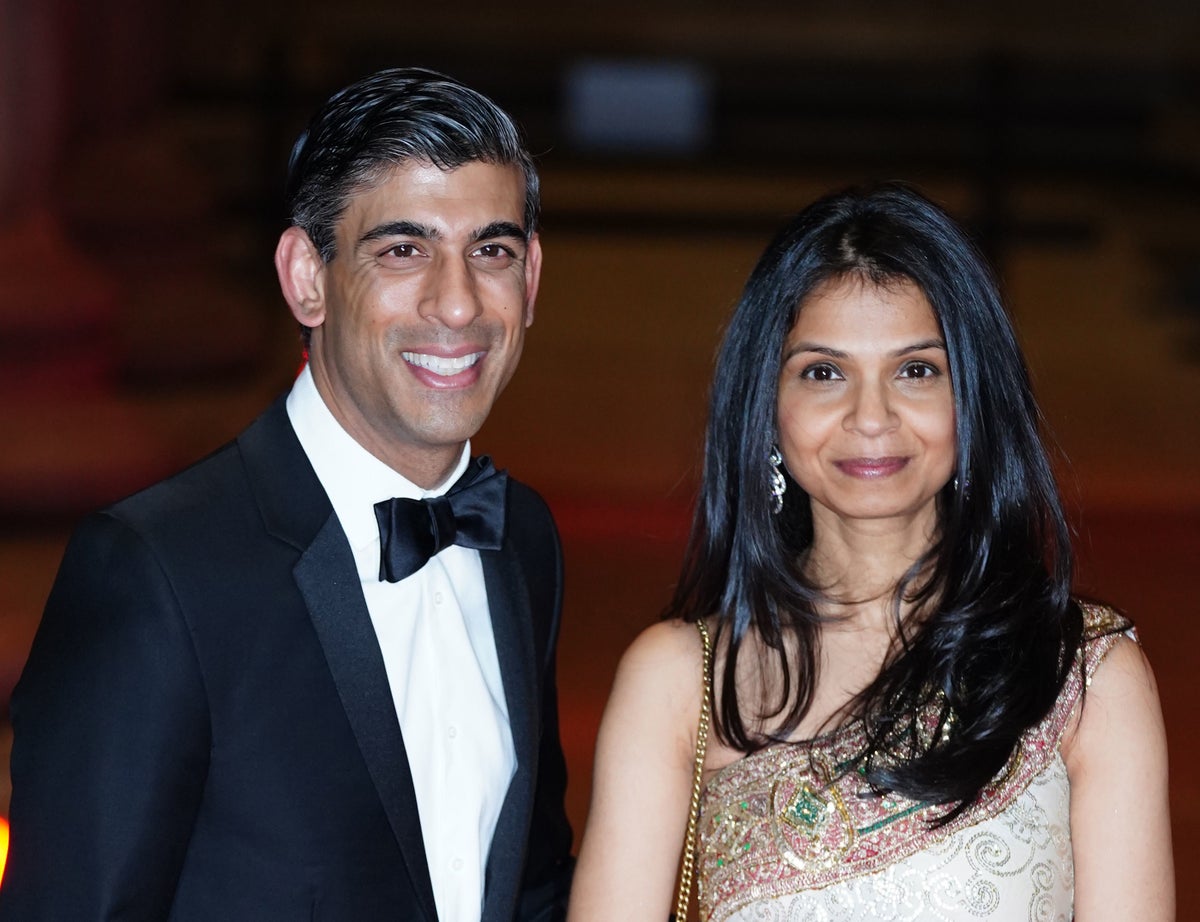

The Independent revealed earlier this year that Rishi Sunak's wife, Akshata Murty, had non-domiciled tax status while her husband was chancellor. Mr Sunak called the reports about his wife "unpleasant smears" at the time, although she eventually gave up the benefit.

The issue was considered so toxic that insiders believed initially that it would undermine Mr. Sunak's hopes of becoming Prime Minister.

Non-dom status, which is legal, can save an individual from paying UK tax on dividends from overseas investments, rent on overseas property or bank interest .

Asking the government to produce figures on non-doms, Shadow Treasury Chief Secretary Pat McFadden said: "As the Tories raise taxes on working people, it's not all just not fair that those at the top can get outdated non-dom tax benefits. If you make Britain your home, you should be paying your taxes here."

He said Labor would ensure that "people who move to the UK contribute to this country by paying tax on their overall income".

Labour also cited research produced by the London School of Economics which aligns with the figure suggested by the IFS, estimating how much the Treasury could raise by removing non-dom status at nearly £3.2 billion a year.< /p>

Earlier this year, the I...

Sign up for Inside Politics email for your briefing free daily on the biggest stories in British politicsGet our free Inside Politics emailPlease enter a valid email addressPlease enter a valid email addressI would like to be notified by email about offers, events and updates from The Independent. Read our privacy notice{{ #verifyErrors }}{{ message }}{{ /verifyErrors }}{{ ^verifyErrors }}An error has occurred. Please try again later{{ /verifyErrors }}

Sign up for Inside Politics email for your briefing free daily on the biggest stories in British politicsGet our free Inside Politics emailPlease enter a valid email addressPlease enter a valid email addressI would like to be notified by email about offers, events and updates from The Independent. Read our privacy notice{{ #verifyErrors }}{{ message }}{{ /verifyErrors }}{{ ^verifyErrors }}An error has occurred. Please try again later{{ /verifyErrors }}Ministers have been told to 'clean up' the economic case for the decision not to scrap UK non-dom status, after the Chancellor hinted that he did not know how much the money that would remove the controversial tax status would rise.

Jeremy Hunt has insisted scrapping the controversial tax status won't help the economy, saying on Friday he'd rather the super-rich 'stay...and spend their money' here". And he said Treasury officials had told him they were "very uncertain" how much money the move would actually bring in.

Labour has now called on ministers to release numbers on how many non-doms there. are in the UK, and the amount the Treasury is currently losing through the loophole.

The highly respected Institute for Fiscal Studies (IFS) think tank told The Independent that its "best estimate" was that abolishing the measure would bring around £3 billion a year. The figure is roughly the same amount announced by Mr Hunt that will be added to next year's NHS budget.

The Independent revealed earlier this year that Rishi Sunak's wife, Akshata Murty, had non-domiciled tax status while her husband was chancellor. Mr Sunak called the reports about his wife "unpleasant smears" at the time, although she eventually gave up the benefit.

The issue was considered so toxic that insiders believed initially that it would undermine Mr. Sunak's hopes of becoming Prime Minister.

Non-dom status, which is legal, can save an individual from paying UK tax on dividends from overseas investments, rent on overseas property or bank interest .

Asking the government to produce figures on non-doms, Shadow Treasury Chief Secretary Pat McFadden said: "As the Tories raise taxes on working people, it's not all just not fair that those at the top can get outdated non-dom tax benefits. If you make Britain your home, you should be paying your taxes here."

He said Labor would ensure that "people who move to the UK contribute to this country by paying tax on their overall income".

Labour also cited research produced by the London School of Economics which aligns with the figure suggested by the IFS, estimating how much the Treasury could raise by removing non-dom status at nearly £3.2 billion a year.< /p>

Earlier this year, the I...

What's Your Reaction?

![Three of ID's top PR executives quit ad firm Powerhouse [EXCLUSIVE]](https://variety.com/wp-content/uploads/2023/02/ID-PR-Logo.jpg?#)