Former VC brings smart financial advice to people who really need it, rather than the wealthy

Will Peng graduated from Princeton with approximately $35,000 in debt.

He asked his immigrant parents what they thought was the best approach for him to repay.

“There were companies telling me I had to refinance my student loans,” recalls Peng, who is the second eldest of six children born in Taiwan. "I also didn't know how I should balance paying off my student loans while creating an emergency fund and putting money into my 401(k)."

So he googled and "read a lot of articles on NerdWallet", but still "made a ton of mistakes".

It was then that Peng realized he was probably not alone in his struggles and thus the idea for his startup, Northstar, was born.

Realizing that receiving financial counseling services is often a luxury reserved for the upper or affluent middle class, Peng decided the best way to make these services more accessible was to partner with employers to provide a financial benefit of well-being to their employees.

“We want to build financial well-being for 100%, not just for 1%,” he said.

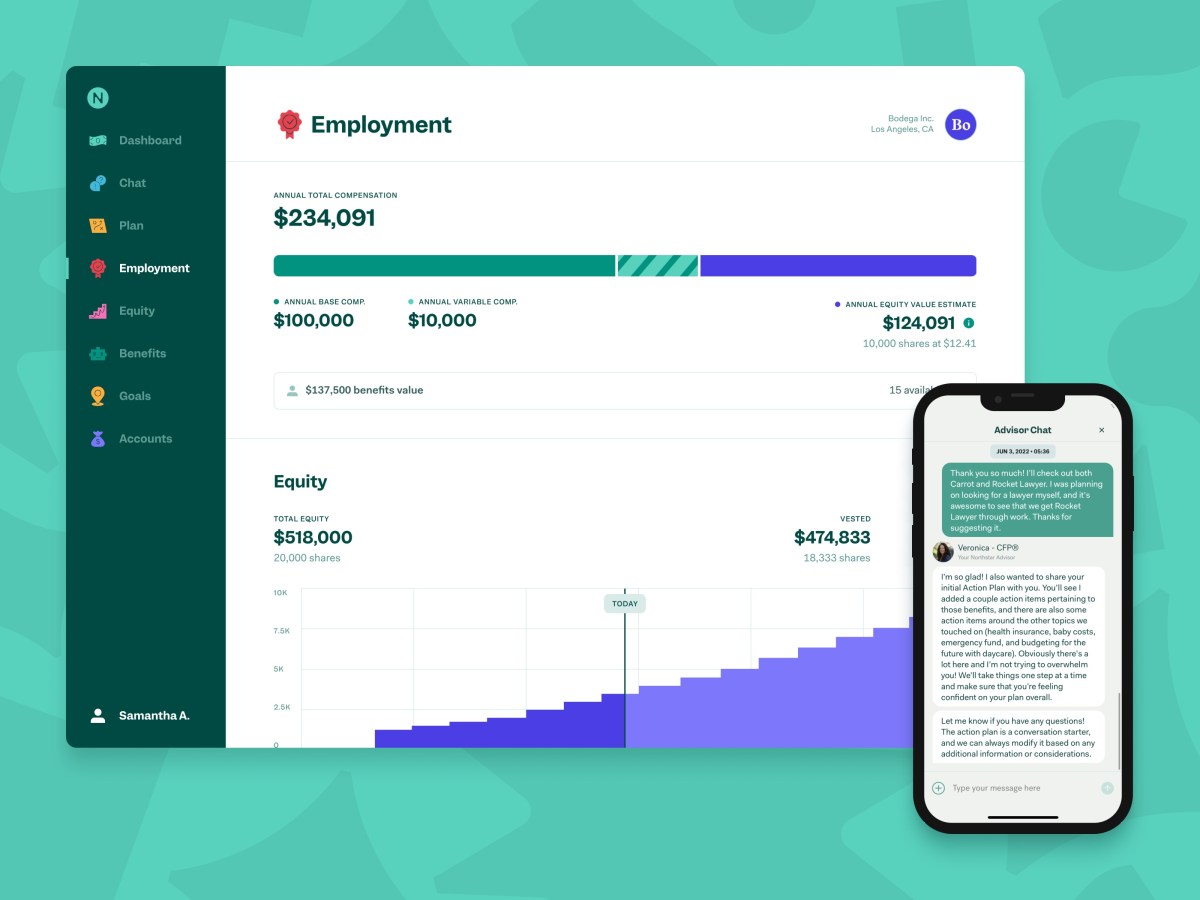

Specifically, Los Angeles-based Northstar has developed a set of personal financial management tools to help guide employees through various financial and life situations with the goal of helping them understand "the full value of their compensation, equity and benefits".

While many of its clients are in technology, they "range in size and industry" and include private and public companies, according to Peng. For example, Northstar's clients include Zoom, Snap, 23andMe, Virgin Orbit, and, ironically, NerdWallet. The company charges employers a monthly subscription based on headcount to give employees one-on-one access to a full-time financial advisor employed by Northstar. Employees pay nothing and there is no commission involved.

Northstar pairs employees with the same consultant so they can feel comfortable and familiar rather than having an employee speak to a different person each time they have a question. And as the company built its team of financial advisors, the company intended to hire a diverse staff so that employees were more likely to speak with people with similar backgrounds to theirs.

It appears Northstar's services are in greater demand than ever in the current challenging macro environment, according to Peng, who was formerly a general partner at Red Swan Ventures for nearly a decade and an early investor in Coinbase , Guideline, Even and Oscar.

While the CEO declined to reveal concrete revenue numbers, he told TechCrunch that Northstar's revenue has grown "more than 5x" year-over-year and that we are expect them to increase 3x year over year next year. Since December 2020, the company has grown its customer base by more than 600%.

"We found that financial wellness is just a big topic, regardless of the distribution channel or how it's actually achieved," Peng said. "It's necessary in good times, but especially in bad times."

And today, Northstar announces it has just raised $24.4 million in a new funding round led by GGV Capital that Peng says took a remarkably quick time to close in a very challenging fundraising environment.

“The time from the first meeting to the term sheet was about a month,” he told TechCrunch.

New investors PayPal Ventures, Thomson Reuters Ventures and Canvas Ventures joined existing backers M13, Workday Ventures, Parade Ventures, Foundation Capital, Designer Fund and RRE to participate in the round, bringing the total raised from Northstar at $40 million since its inception in 2016.

While he declined to reveal the valuation, Peng noted that the new funding was a "significant increase".

The need for his offering is greater than ever because, according to Peng, while consumers have access to more "awesome" tools than ever before, they still lack the knowledge to know what to do with them.

"It actually exacerbated the problem: this unfair expectation that people actually know what to do with their finances," Peng said.

“Financial advice is something everyone needs. It’s not just those with stock compensation, for example,” he added. “If you get a paycheck, if you're on benefits, you deserve financial advice."

Will Peng graduated from Princeton with approximately $35,000 in debt.

He asked his immigrant parents what they thought was the best approach for him to repay.

“There were companies telling me I had to refinance my student loans,” recalls Peng, who is the second eldest of six children born in Taiwan. "I also didn't know how I should balance paying off my student loans while creating an emergency fund and putting money into my 401(k)."

So he googled and "read a lot of articles on NerdWallet", but still "made a ton of mistakes".

It was then that Peng realized he was probably not alone in his struggles and thus the idea for his startup, Northstar, was born.

Realizing that receiving financial counseling services is often a luxury reserved for the upper or affluent middle class, Peng decided the best way to make these services more accessible was to partner with employers to provide a financial benefit of well-being to their employees.

“We want to build financial well-being for 100%, not just for 1%,” he said.

Specifically, Los Angeles-based Northstar has developed a set of personal financial management tools to help guide employees through various financial and life situations with the goal of helping them understand "the full value of their compensation, equity and benefits".

While many of its clients are in technology, they "range in size and industry" and include private and public companies, according to Peng. For example, Northstar's clients include Zoom, Snap, 23andMe, Virgin Orbit, and, ironically, NerdWallet. The company charges employers a monthly subscription based on headcount to give employees one-on-one access to a full-time financial advisor employed by Northstar. Employees pay nothing and there is no commission involved.

Northstar pairs employees with the same consultant so they can feel comfortable and familiar rather than having an employee speak to a different person each time they have a question. And as the company built its team of financial advisors, the company intended to hire a diverse staff so that employees were more likely to speak with people with similar backgrounds to theirs.

It appears Northstar's services are in greater demand than ever in the current challenging macro environment, according to Peng, who was formerly a general partner at Red Swan Ventures for nearly a decade and an early investor in Coinbase , Guideline, Even and Oscar.

While the CEO declined to reveal concrete revenue numbers, he told TechCrunch that Northstar's revenue has grown "more than 5x" year-over-year and that we are expect them to increase 3x year over year next year. Since December 2020, the company has grown its customer base by more than 600%.

"We found that financial wellness is just a big topic, regardless of the distribution channel or how it's actually achieved," Peng said. "It's necessary in good times, but especially in bad times."

And today, Northstar announces it has just raised $24.4 million in a new funding round led by GGV Capital that Peng says took a remarkably quick time to close in a very challenging fundraising environment.

“The time from the first meeting to the term sheet was about a month,” he told TechCrunch.

New investors PayPal Ventures, Thomson Reuters Ventures and Canvas Ventures joined existing backers M13, Workday Ventures, Parade Ventures, Foundation Capital, Designer Fund and RRE to participate in the round, bringing the total raised from Northstar at $40 million since its inception in 2016.

While he declined to reveal the valuation, Peng noted that the new funding was a "significant increase".

The need for his offering is greater than ever because, according to Peng, while consumers have access to more "awesome" tools than ever before, they still lack the knowledge to know what to do with them.

"It actually exacerbated the problem: this unfair expectation that people actually know what to do with their finances," Peng said.

“Financial advice is something everyone needs. It’s not just those with stock compensation, for example,” he added. “If you get a paycheck, if you're on benefits, you deserve financial advice."

What's Your Reaction?