How was Main Street in July?

Main Street remains resilient despite the growing list of challenges and ripples it faces. Small business owners and employees face a growing list of challenges: Consumer prices rose at the fastest rate in 40 years in June. On the employment and hiring front, some of the world's largest and most important companies have announced layoffs, hiring freezes or hiring slowdowns. Consumer confidence and mood are down.

Experts also now estimate a higher likelihood of a recession over the next year, given the impact of inflation on corporate earnings and the policy imperatives of the Fed. Wall Street analysts continue to cut earnings and benchmark estimates. Bellwether companies such as Walmart lowered their profit estimates citing slowing consumer retail sales. Jobless claims continue to rise and are now at the highest weekly level since November 2021. Positive news includes falling commodity prices, including for oil; lower mortgage rates and interest rates; and a still strong hiring market.

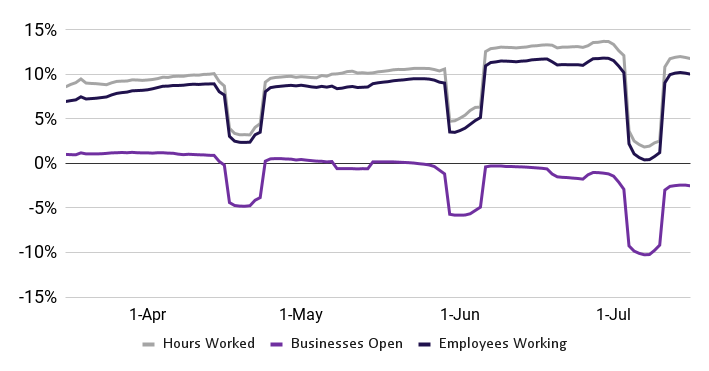

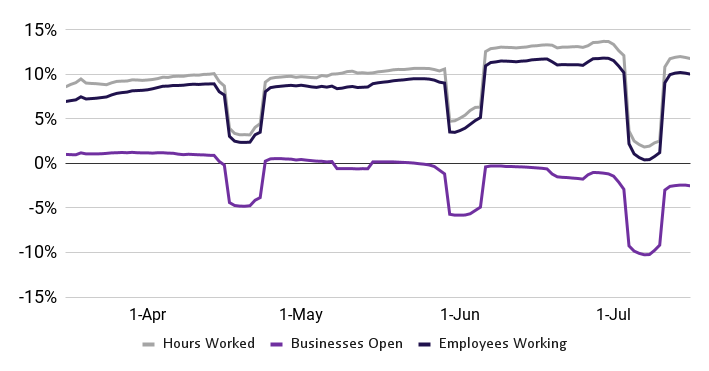

Our own key high street health metrics for July showed some slowdown in hours worked (a reduction of around 12%) and employees working compared to June. However, these metrics remain higher compared to January 2022 and compare favorably to the pre-pandemic period.

Main Street Health Metrics (7-day rolling average; relative to January 2022)

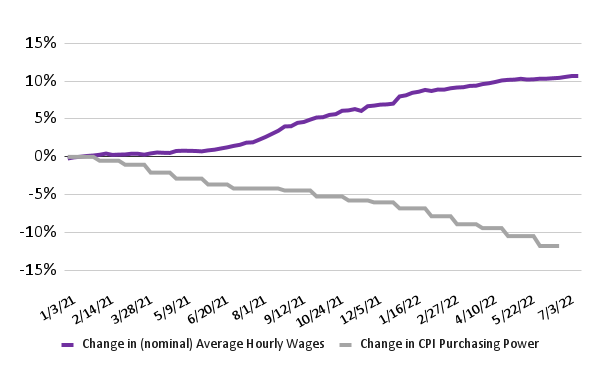

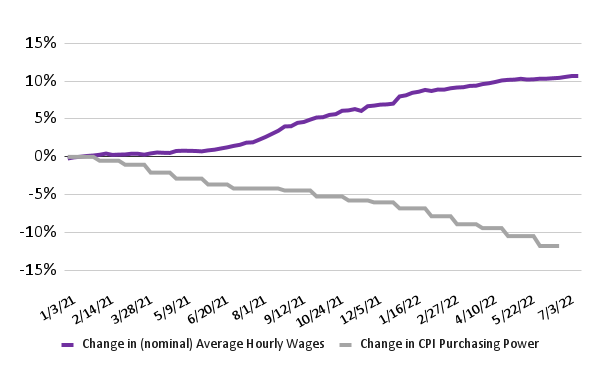

Average nominal hourly wages have increased by almost 10% since the start of 2021. Average (nominal) hourly wages in mid-June remained about 10% higher than January 2021 estimates. data from mid-July suggests that wage inflation rose moderately from June and did not keep up with inflation.

Percentage change in nominal average hourly wages and consumer dollar CPI purchasing power from January 2021 baseline1

Most employees worry about a recession; there is some variation based on political orientation. Based on a survey of approximately 700 employees in mid-July, we found that employees are either very (32%) or...

Main Street remains resilient despite the growing list of challenges and ripples it faces. Small business owners and employees face a growing list of challenges: Consumer prices rose at the fastest rate in 40 years in June. On the employment and hiring front, some of the world's largest and most important companies have announced layoffs, hiring freezes or hiring slowdowns. Consumer confidence and mood are down.

Experts also now estimate a higher likelihood of a recession over the next year, given the impact of inflation on corporate earnings and the policy imperatives of the Fed. Wall Street analysts continue to cut earnings and benchmark estimates. Bellwether companies such as Walmart lowered their profit estimates citing slowing consumer retail sales. Jobless claims continue to rise and are now at the highest weekly level since November 2021. Positive news includes falling commodity prices, including for oil; lower mortgage rates and interest rates; and a still strong hiring market.

Our own key high street health metrics for July showed some slowdown in hours worked (a reduction of around 12%) and employees working compared to June. However, these metrics remain higher compared to January 2022 and compare favorably to the pre-pandemic period.

Main Street Health Metrics (7-day rolling average; relative to January 2022)

Average nominal hourly wages have increased by almost 10% since the start of 2021. Average (nominal) hourly wages in mid-June remained about 10% higher than January 2021 estimates. data from mid-July suggests that wage inflation rose moderately from June and did not keep up with inflation.

Percentage change in nominal average hourly wages and consumer dollar CPI purchasing power from January 2021 baseline1

Most employees worry about a recession; there is some variation based on political orientation. Based on a survey of approximately 700 employees in mid-July, we found that employees are either very (32%) or...

What's Your Reaction?