Slowdown continues for small businesses

In recent months, economists and regulators have worried about the impact of continued wage growth on inflation and the outlook for employers. After significant rate hikes from the Fed, indicators are slowly starting to recover.

Our data from the United States and Canada reflect a new ebb of economic activity in small businesses.

Previous iterations of this report have cited lingering concerns about the pace of wage growth and weak jobless claims, leading the Fed to maintain its tough approach to rate hikes. As signals of a booming economy begin to fade, Homebase seeks to understand how the broader economic environment is affecting small businesses and their employees in early 2023 by analyzing behavioral data from over two million people. employees working in more than one hundred thousand SMEs. .

Summary of Findings: Homebase High-Frequency Timesheet Data Indicates Continued Slowdown in Hours Worked and Employees Working, Across Most Industries and Major Metro Areas

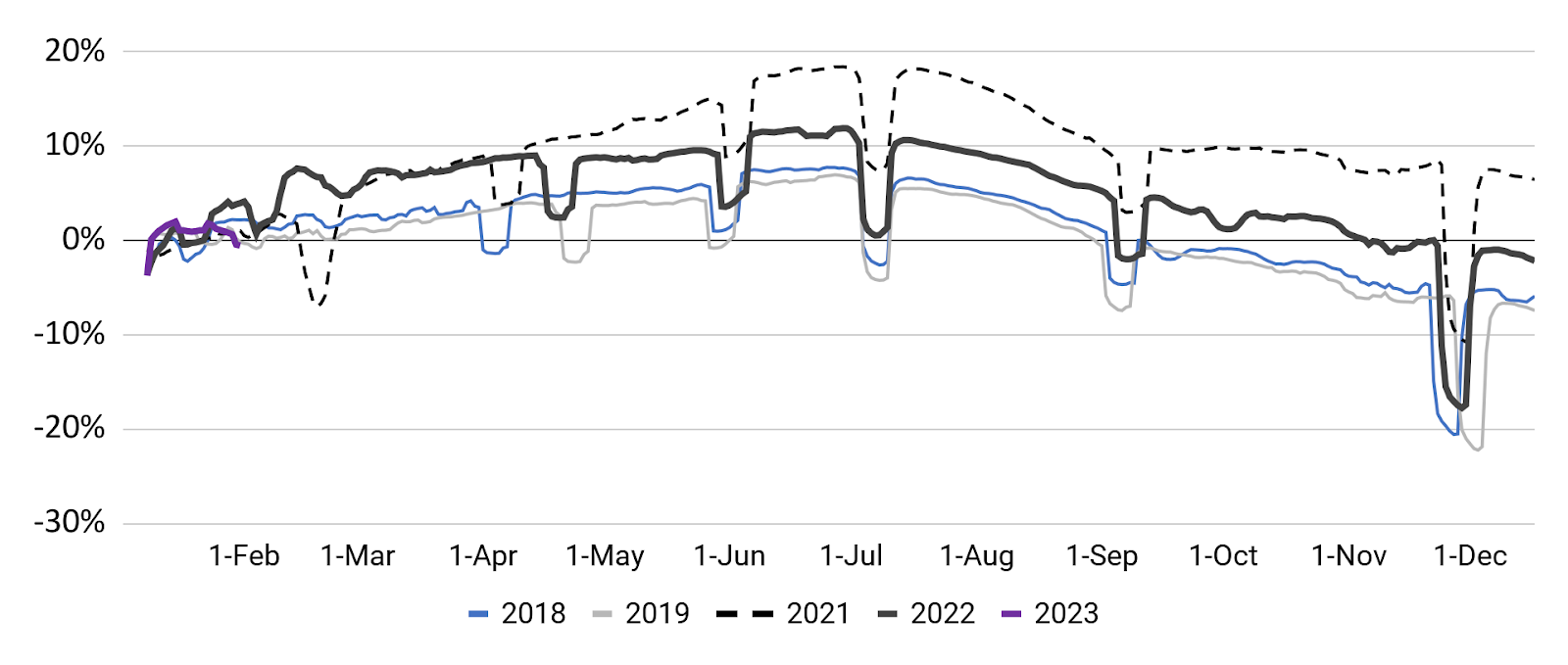

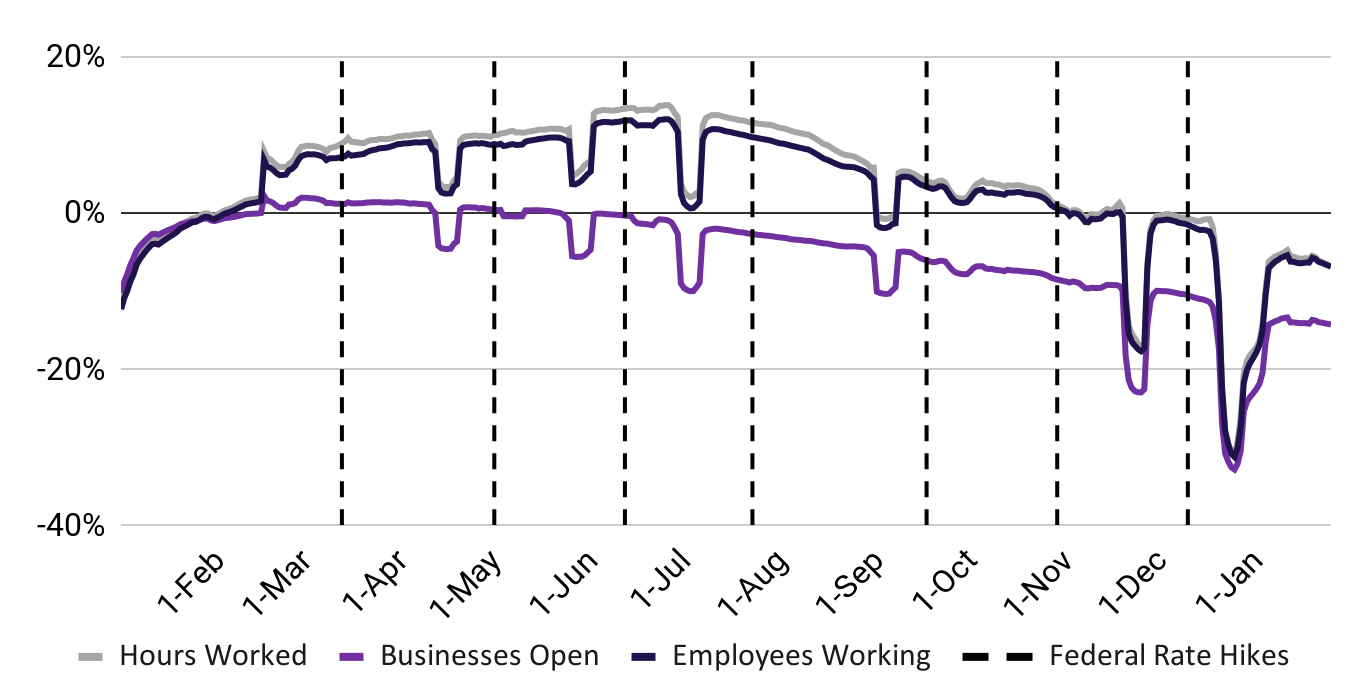

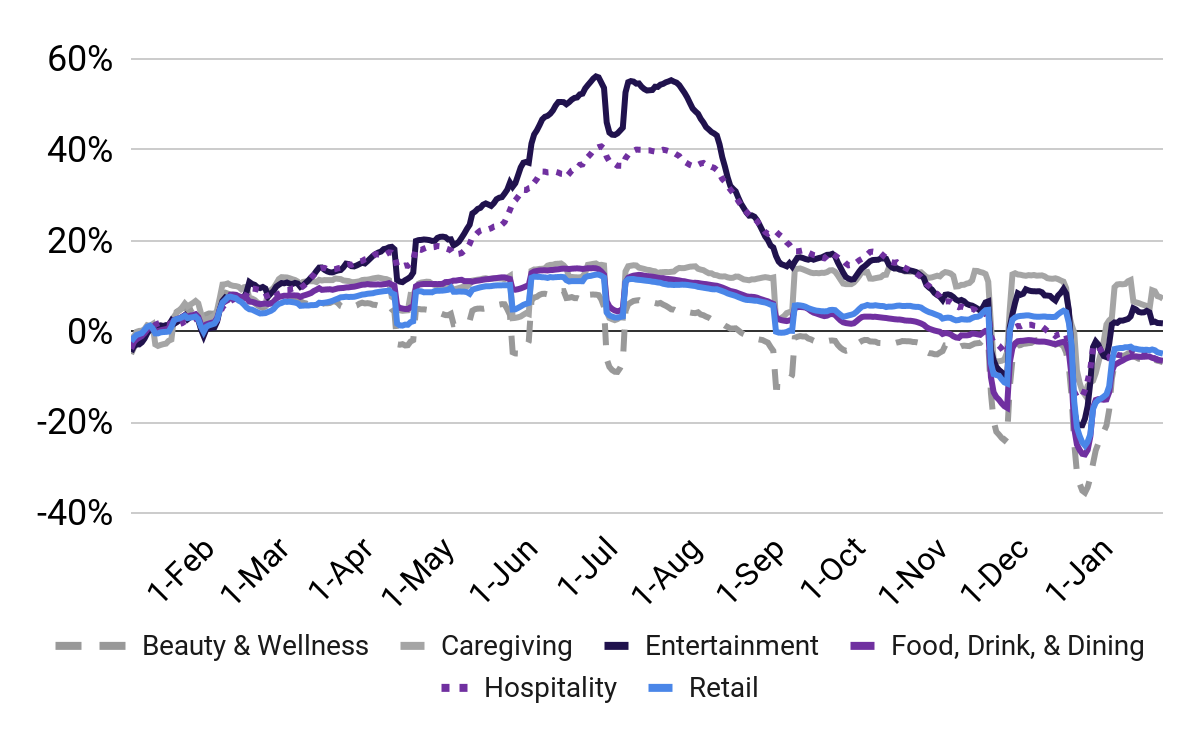

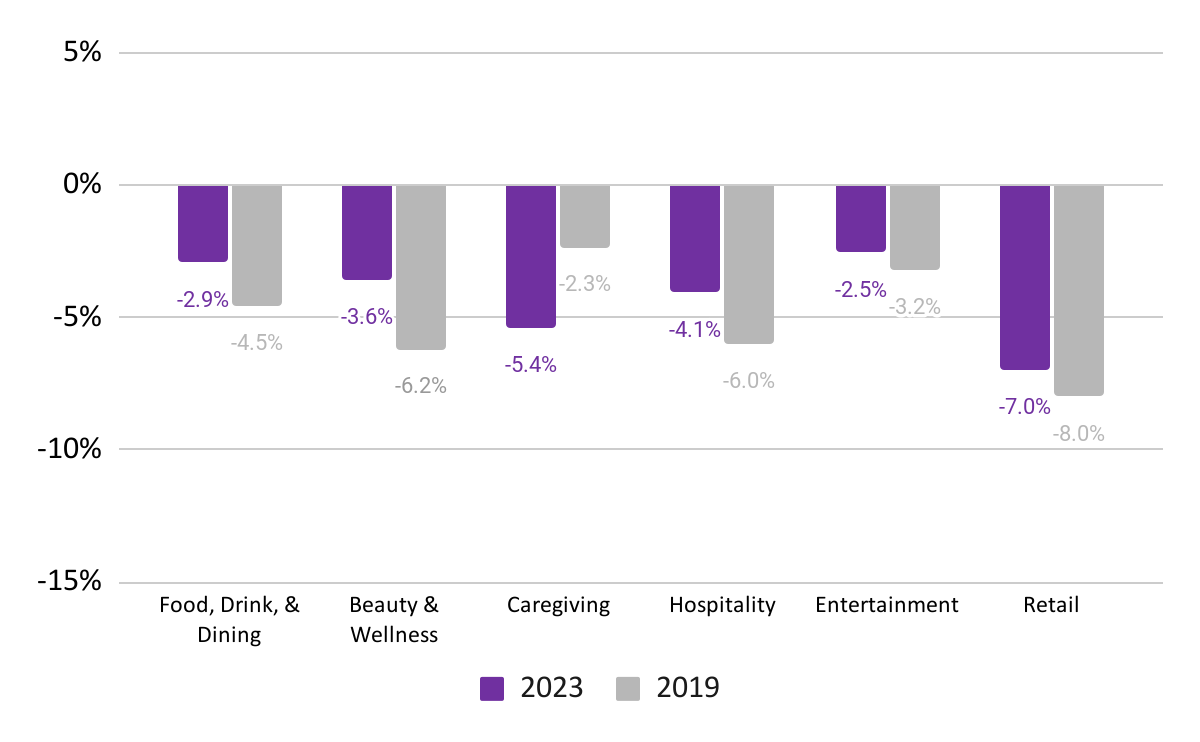

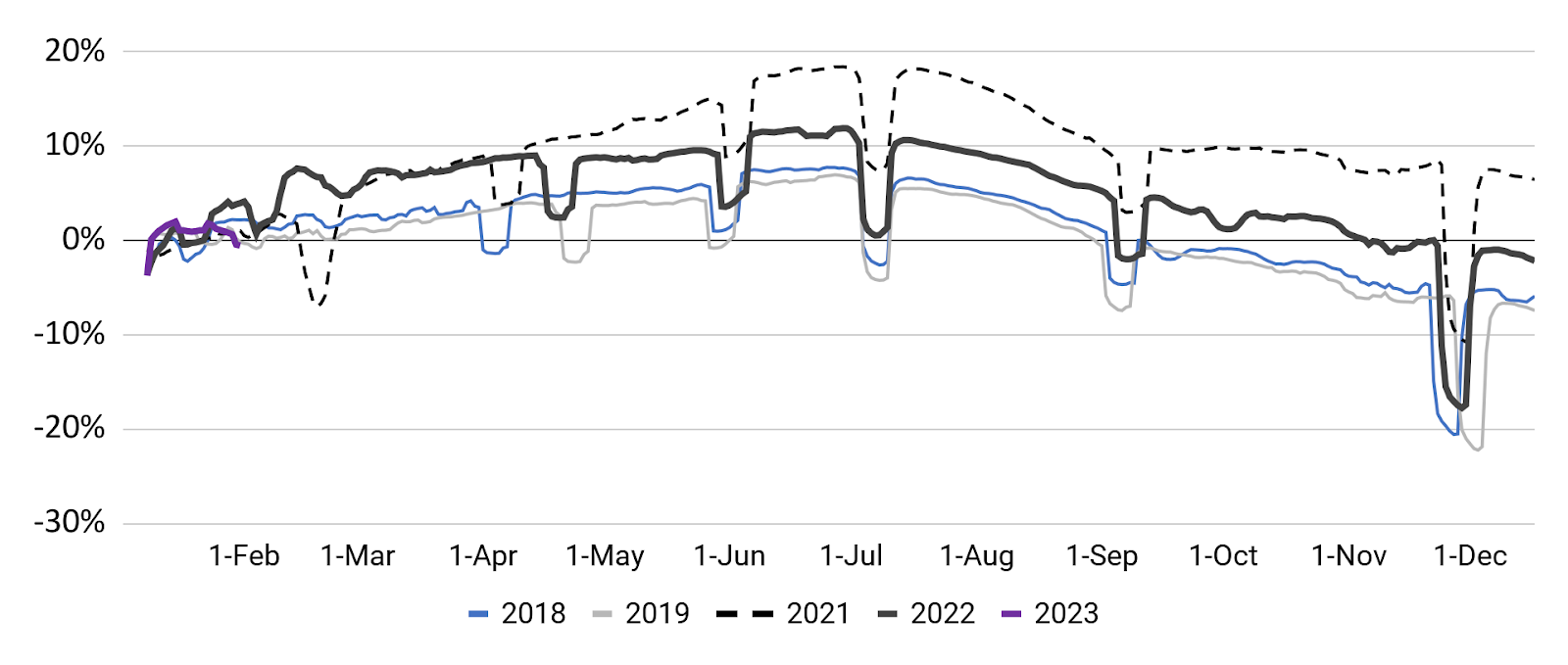

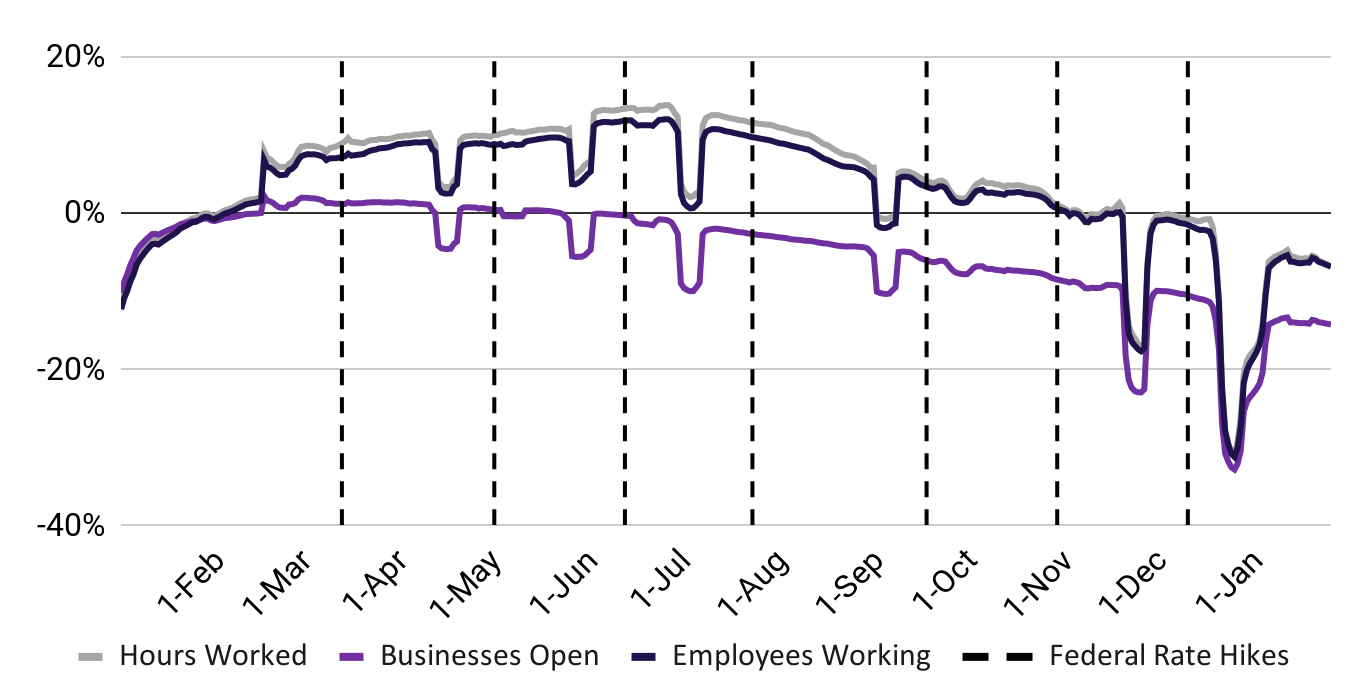

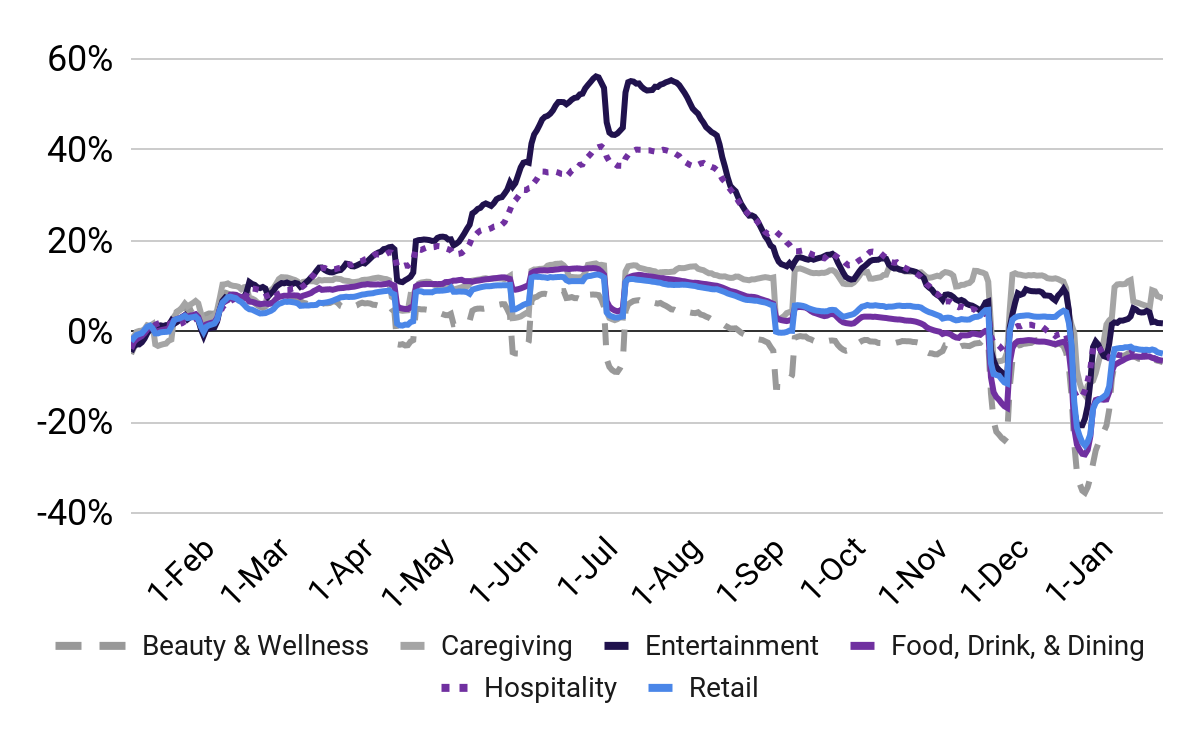

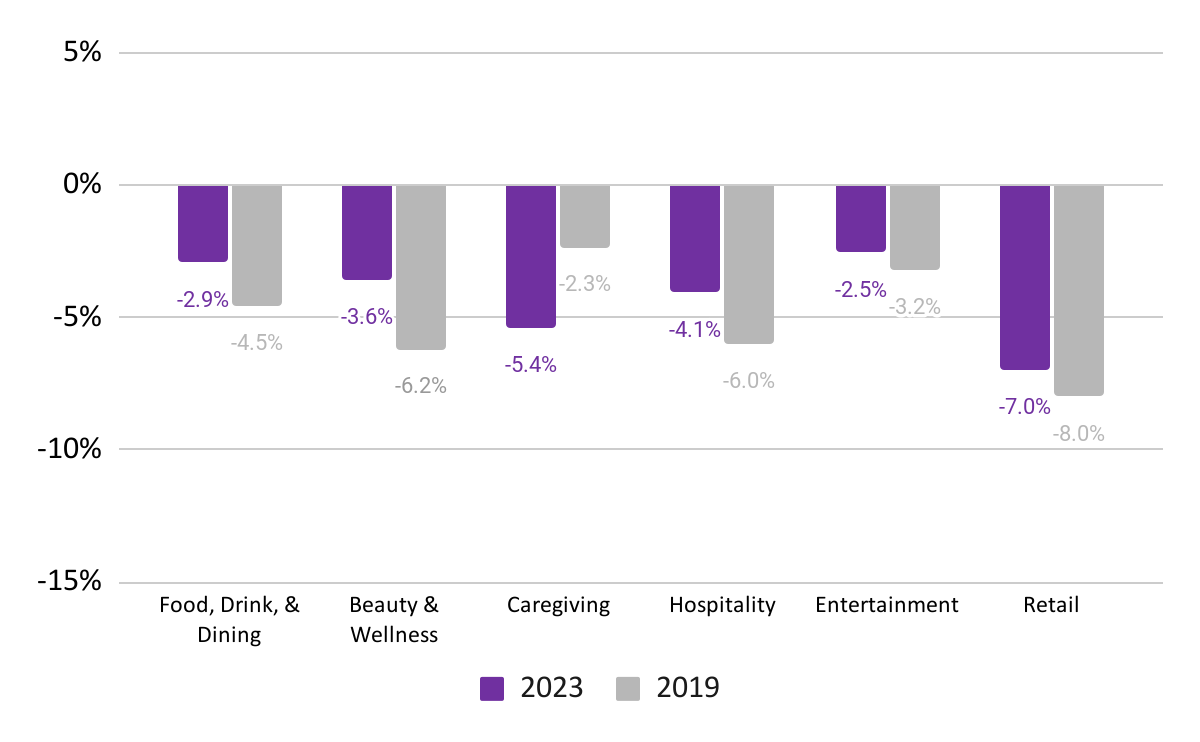

January got off to a slow start with a continued downward trajectory; while 2022 saw growth in hours worked through the first quarter of 2023, the levels of employees working and hours worked are 4 to 5 percentage points lower than their January 2022 values. Post-holiday declines across industries are smaller than what we saw pre-COVID, with the exception of healthcare; Workforce participation in entertainment rebounded the most significantly from holiday lows, just 2.3% below mid-December levels. Hours worked in metropolitan areas remain slightly below their pre-holiday levels, a trend similar to previous years; however, January 2023 levels remained relatively constant throughout the month, instead of increasing as they did in 2021 and 2022.January got off to a slow start with a continued downward trajectory; while 2022 saw growth in hours worked through the first quarter of 2023, levels of employees working and hours worked are 4-5 percentage points lower than their January 2022 levels.

Employees working (7-day moving average; relative to January of current year)

Post-holiday declines in all sectors are weaker than what we saw pre-COVID, with the exception of healthcare; labor force participation in the entertainment sector rebounded the most significantly from holiday lows, just 2.3% below mid-December levels.

Percentage change in the number of employees working (Relative to January 2022 baseline using 7-day moving average)1

In recent months, economists and regulators have worried about the impact of continued wage growth on inflation and the outlook for employers. After significant rate hikes from the Fed, indicators are slowly starting to recover.

Our data from the United States and Canada reflect a new ebb of economic activity in small businesses.

Previous iterations of this report have cited lingering concerns about the pace of wage growth and weak jobless claims, leading the Fed to maintain its tough approach to rate hikes. As signals of a booming economy begin to fade, Homebase seeks to understand how the broader economic environment is affecting small businesses and their employees in early 2023 by analyzing behavioral data from over two million people. employees working in more than one hundred thousand SMEs. .

Summary of Findings: Homebase High-Frequency Timesheet Data Indicates Continued Slowdown in Hours Worked and Employees Working, Across Most Industries and Major Metro Areas

January got off to a slow start with a continued downward trajectory; while 2022 saw growth in hours worked through the first quarter of 2023, the levels of employees working and hours worked are 4 to 5 percentage points lower than their January 2022 values. Post-holiday declines across industries are smaller than what we saw pre-COVID, with the exception of healthcare; Workforce participation in entertainment rebounded the most significantly from holiday lows, just 2.3% below mid-December levels. Hours worked in metropolitan areas remain slightly below their pre-holiday levels, a trend similar to previous years; however, January 2023 levels remained relatively constant throughout the month, instead of increasing as they did in 2021 and 2022.January got off to a slow start with a continued downward trajectory; while 2022 saw growth in hours worked through the first quarter of 2023, levels of employees working and hours worked are 4-5 percentage points lower than their January 2022 levels.

Employees working (7-day moving average; relative to January of current year)

Post-holiday declines in all sectors are weaker than what we saw pre-COVID, with the exception of healthcare; labor force participation in the entertainment sector rebounded the most significantly from holiday lows, just 2.3% below mid-December levels.

Percentage change in the number of employees working (Relative to January 2022 baseline using 7-day moving average)1

What's Your Reaction?